Refined from Societe Generale Securities: a leading domestic innovative monoclonal antibody drug company

The treatment of cancer has always been a world-class research topic. In recent years, a new type of anti-cancer therapy has created several miracles of "clinical cure" of advanced cancer one after another, and has become a "cardiotonic" in the fight against cancer. This new anti-cancer therapy is immunotherapy, of which the most eye-catching and clinically widely used is immune checkpoint inhibitor PD-1/PD-L1 immunotherapy.INNOVENT BIO'sXindirizumab is expected to be the first batch to be put on the market in 2019, with a first-mover advantage.

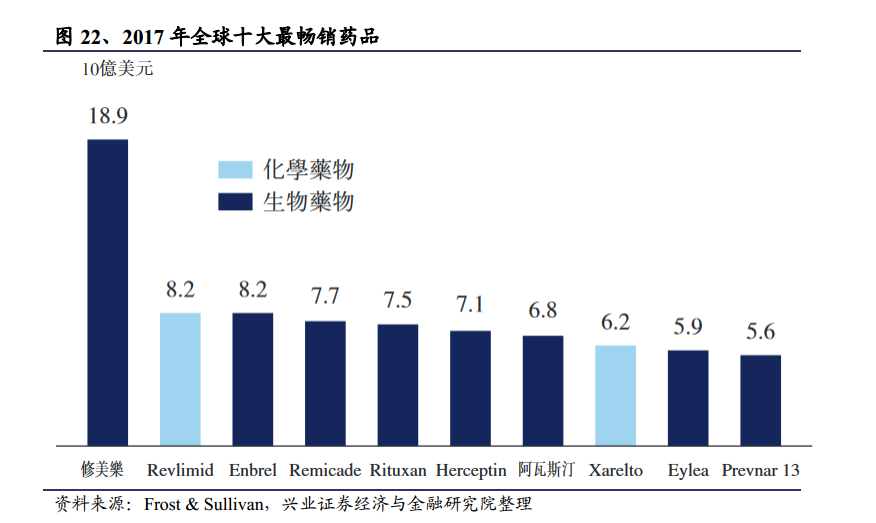

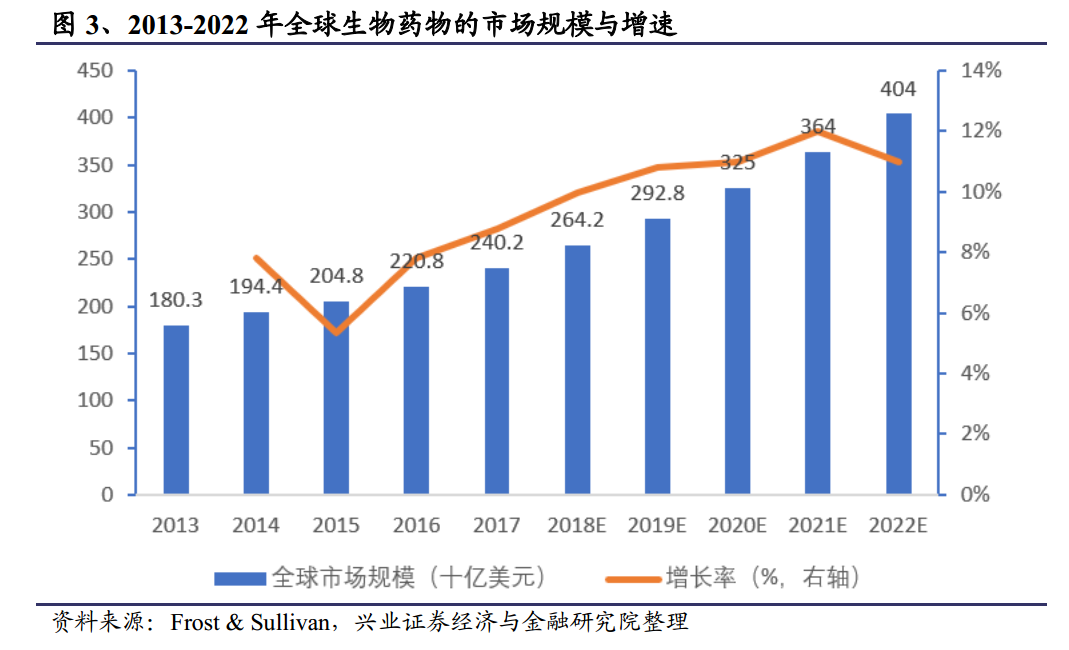

The global biomedicine market is in the ascendant, and monoclonal antibody is the king in the biomedicine market.

Sales revenue in China's biopharmaceutical market increased from 86.2 billion yuan in 2013 to 218.5 billion yuan in 2017, with a compound annual growth rate of 26.2 percent.It is expected that from 2017 to 2022, it will further grow at a compound annual growth rate of 17.0%, and the sales revenue will reach 478.5 billion yuan in 2022. There is still much room for improvement in the domestic McAb market.China's monoclonal antibody (including fusion protein) market accounts for only 5.4% of China's overall biopharmaceutical market, compared with the global biopharmaceutical market in 2017, McAb accounts for 43.2% of the market share.

PD-1 and PD-L1 antibodies have great potential.

PD-1 and PD-L1 antibodies have obvious advantages, and the indications are constantly expanding.At present, five kinds of PD-1 and PD-L1 antibodies have been approved and listed worldwide, including PD-1 antibodies Keytruda and Opdivo and PD-L1 antibodies Tecentriq, Bavencio and Imfinzi. PD-1 and PD-L1 antibodies are especially effective against melanoma, non-small cell lung cancer and other solid tumors.And the combination therapy of PD-1 antibody and chemotherapeutic drugs often showed the effect of 1: 1 > 2.

The global market for PD-1 antibodies is growing rapidly.In the case of PD-1 antibody Keytruda and Opdivo alone, from 2014 to 2017, Opdivo's global sales revenue increased from US $20 million to US $5.753 billion, while Keytruda's global sales revenue increased from US $55 million to US $3.809 billion.

INNOVENT BIO is innovation-driven and has rich pipelines and great potential.

INNOVENT BIO has established a product line of 17 antibody drug candidates in the past 7 years.Covering four major disease areas, including tumors, fundus diseases, autoimmune diseases and cardiovascular diseasesAmong them, 4 kinds of core products which entered the late clinical development in China are in the leading position, and 9 products have been approved by CFDA clinical trials.

Xindili Monoclonal Antibody: it is expected to launch the first batch in 2019, with a first-mover advantage.Cindilizumab is an innovative all-human PD-1 monoclonal antibody, which was approved by CFDA in September 2016. Currently, it has officially applied to CFDA for the indication of relapsed / refractory classical Hodgkin's lymphoma. It is one of the first batch of PD-1 monoclonal antibodies to be accepted for new drug application (NDA) in China and is expected to be sold in China in 2019.

INNOVENT BIO submitted an IPO application for Hong Kong stocks with a luxurious investor lineup.

INNOVENT BIO became the third biotech company to list in Hong Kong without revenue (GE Li and Hua Ling, who previously submitted the prospectus). INNOVENT BIO, who has been established for only seven years, has so far raised 11 rounds of financing (including joint venture investment), raising a total of about US $557 million, or nearly 3.6 billion yuan, or about 500 million yuan a year.

Among the domestic investors, including the advanced manufacturing industry investment fund with the executive partner of China Investment Innovation Investment Management Co., Ltd., Ping An Insurance capital, Jun Lian Capital, China Life Insurance Capital, Taikang Insurance, etc., the platform capital is "strong", but the shareholding ratio of the investment fund is about 70%, which may have an impact on the operation of the stock price in the later period.

For more wonderful content, please mark: the past period of the rich way research election.