Fine-edited from Shen Wanhongyuan Securities: reviewing the development history of Umico and excavating China's positive growth stocks

The main application fields of lithium battery include power, energy storage and 3C, etc.With the determination of the growth trend of new energy vehicles, power lithium battery has become the main driving force of global lithium battery demand growth. High mileage for higher energy density, the cathode material ternary high nickel becomes the general trend.

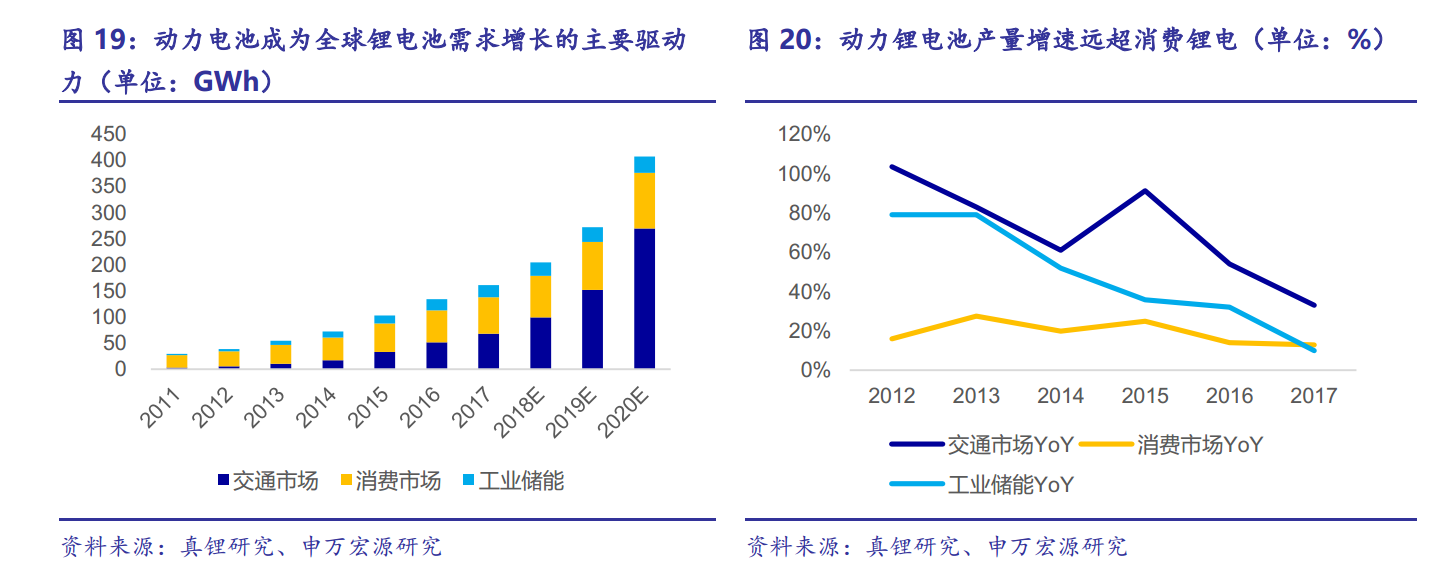

1. Power battery has become the main driving force of global lithium battery demand growth.

The demand for lithium batteries in power and energy storage accounted for 54% in 2016, surpassing the share of consumer applications for the first time.According to True Lithium Research data, the global lithium market was 134GWh in 2016, an increase of 29.8% over the same period last year. Among them, the output of power lithium batteries was 51Gwh, up 54.1% from the same period last year, while the output of 3C lithium batteries was 62Gwh in 16 years, up 14.0% from the same period last year. According to this growth rate, after 2019, the proportion of power lithium batteries is expected to surpass the consumer field and become the leading application field of the lithium battery market.

2. The innovation of lithium battery is mainly accompanied by the update of cathode material technology.

Combing the history of research and development and commercialization of lithium batteries, we can find outThe main research and development direction of lithium battery is to improve the electrical conductivity and energy density of materials.And because the specific capacity of the cathode material is smaller than that of the negative materialResearch and development is mainly focused on the field of cathode materials.

Figure 16: the proportion of ternary materials in the world will continue to increase (in 10,000 tons,%)

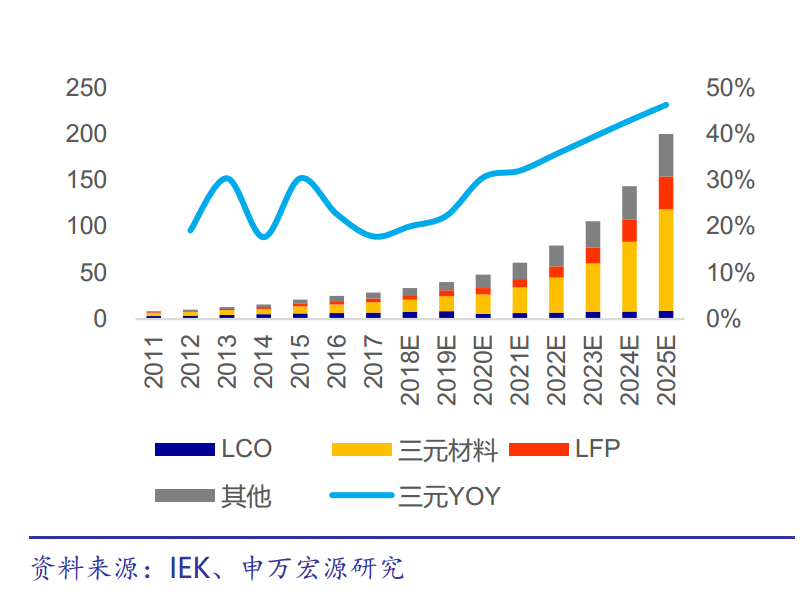

3. The global lithium cathode market is expected to reach 286.3 billion yuan in 2025, and the share of ternary materials demand will increase to 53%.

In 2017, the global demand for cathode materials is about 313400 tons, corresponding to the market size of 65.1 billion yuan, of which the demand for ternary cathode materials is 110000 tons, accounting for about 35.6%. With the continuous expansion of the global new energy vehicle market, the demand for power batteries drives the rapid growth of the global cathode material market. It is estimated that the global installed capacity of lithium batteries will reach 1692Gwh by 2025, corresponding to 2.0559 million tons of cathode demand, and the market size is expected to reach 286.3 billion yuan. Among them, the installation of power batteries is expected to break through 1400Gwh, corresponding to the demand for cathode materials of 1.6598 million tons, accounting for about 80.7%. The demand for ternary materials will be about 1.0993 million tons in 2025, accounting for 53% of the total.

4. Cathode material manufacturers account for a large proportion of raw material costs, and the rising price of raw materials supports the price of cathode materials.

More than 90% of the cost of cathode material enterprises is raw materials. For ternary cathode products, cobalt salts and lithium salts account for a high proportion of costs, accounting for about 70% and 80%. Cathode material manufacturers mainly adopt the pricing method of raw materials + processing fee, and the processing fee is relatively fixed.

5. 2018 is the first year of the development of high nickel cathode materials in China.

Shen Cheng Hongyuan believes that the competition pattern of domestic cathode materials is scattered and there is structural overcapacity. LFP and low-end ternary NCM111, 523, etc., there is overcapacity, while the supply of high-nickel ternary materials such as NCM811 and NCA is far less than the demand. From the perspective of the domestic market, NCM523 and 622 are considered mainstream cathode materials, but considering that Rongbai Lithium Power (formerly Ningbo Jinhe), Dangsheng Technology and Cedar Energy have been put into production of NCM811 and NCA products in the second half of 2017, 2018 is expected to become the first year of the development of high nickel ternary cathode in China. In the next three years, the demand for NCM811 and NCA will increase significantly, and it is estimated that the demand for both will reach 47000 tons and 41000 tons respectively in 2020.

For more wonderful content, please mark: the past period of the rich way research election.