Edited by CITIC: controlling Resources and deducing the growth Story of Mining Giants

1. Successful transformation of international mining giants

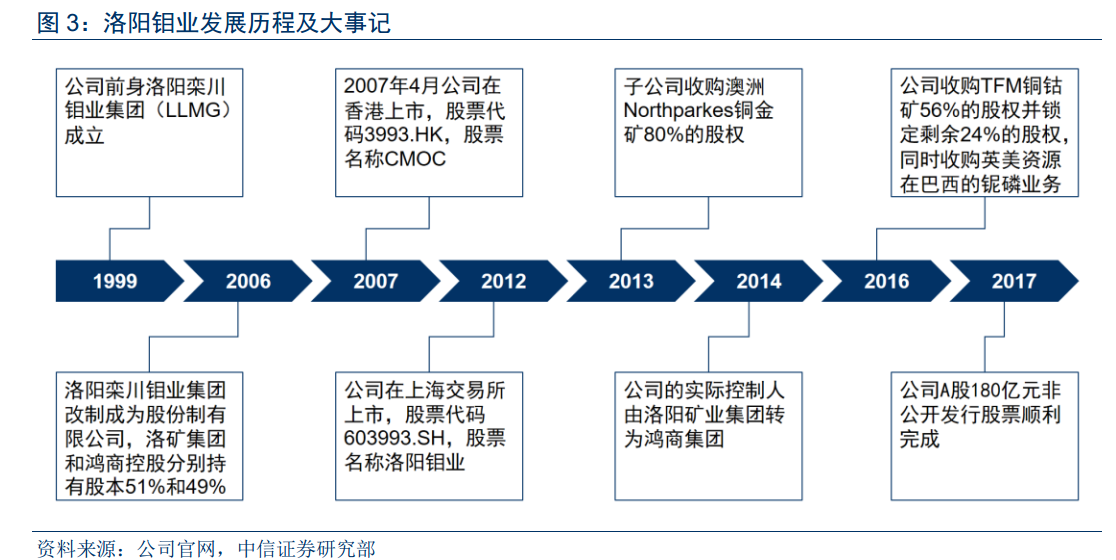

Originally a leading producer of molybdenum and tungsten in China, the company acquired Northparkes Copper and Cobalt Mine (NPM) in Australia in 2013 and Tenke Copper and Cobalt Mine (TFM) in Congo and Brazil in 2016. At present, the company has formed an international mining giant with diversified portfolio based on copper-cobalt, molybdenum-tungsten and phosphorus-niobium business.

2. The proportion of copper and cobalt business has increased significantly, becoming the most important source of revenue and profit for the company.

In 2017, the company achieved revenue of 24.148 billion yuan, an increase of 247.47% over the same period last year, and a net profit of 2.728 billion yuan, an increase of 173.32% over the same period last year. The substantial increase in performance is mainly due to the completion of overseas mergers and acquisitions in the fourth quarter of 2016, and the integration of the DRC copper and cobalt business and the Brazilian phosphorus and niobium business into the company's performance. In 2017, the company's copper and cobalt business accounted for 57.3% of operating income and 62.0% of gross profit, surpassing molybdenum and tungsten as the company's main source of profit.The company has changed from operating molybdenum and tungsten to a comprehensive non-ferrous metal mining giant with copper and cobalt as the main business.

3. Industry analysis: upstream supply is tight and metal prices enter an upward cycle.

Cobalt: the explosive growth of the new energy automobile industry opens the high price of cobalt.The long-term prosperity of new energy vehicles has driven the growth of cobalt consumption. It is estimated that the global consumption of cobalt driven by new energy vehicles will exceed 33000 tons in 2020, CAGR will maintain more than 10% in 2018-2020, and the shortage of cobalt supply will reach 8700 tons in 2020. The average price of cobalt in 2018 is expected to be 600000 yuan per ton.

Copper: ushering in an era of upstream supply shortage.Affected by the resource cycle, there will be an obvious shortage of copper supply in the upstream, and consumption in the lower reaches will maintain steady growth. It is estimated that the copper price from 2018 to 2020 will be 6700 and 7200 pounds per ton.

![2018070064535576504d3af6b.png]()

Molybdenum, tungsten, niobium and phosphorus: prices are picking up.Domestic molybdenum and tungsten upstream supply is tight, downstream consumption is better to stimulate price rise, phosphorus and niobium cycle up at the bottom, prices are easy to rise and difficult to fall.

4. Competitive advantage: international mining aircraft carrier with multiple assets

Has a world-class copper and cobalt mine, resource endowment leading the world.The TFM copper-cobalt mine acquired by the company is one of the best copper-cobalt mines in the world, with copper reserves of 25 million tons and cobalt reserves of more than 2 million tons, with high grade and low cost.At present, as the world's second largest cobalt mine producer, the company has an annual output of more than 16000 tons of cobalt.The company is the world's leading copper producer, with an annual output of more than 200000 tons of copper. The upward price of copper and cobalt will lead to a significant increase in the company's performance.

![201807006453631b6d8d7d6d6.png]()

![2018070064536474dd9215b81.png]()

Domestic molybdenum and tungsten leading enterprises have significant cost advantages.The company is the top five molybdenum producer and the largest scheelite producer in the world, with an annual output of 17000 tons of molybdenum and 12000 tons of tungsten. The company's Sandaozhuang tungsten-molybdenum mine is the largest single tungsten mine in production in China, with molybdenum and tungsten reserves of nearly 500000 tons, and the associated tungsten ore characteristics make the production cost significantly lower than that of domestic counterparts. The company's molybdenum output remains stable, tungsten output continues to increase, production costs maintain a downward trend, the leading position of domestic molybdenum and tungsten is stable.

Niobium and phosphorus prices warmed up, stable contribution to revenue and profit thickening.The company is currently the second largest niobium producer in the world and the second largest phosphate fertilizer producer in Brazil, with an annual output of about 9000 tons of niobium metal and 1.2 million tons of phosphate fertilizer; the company has the second largest niobium ore resources in the world and P2O5 resources with the highest taste in Brazil, and has a broad storage space. With the recovery of product prices, the niobium-phosphorus plate will continue to bring revenue and profit growth for the company.