Edited by Anxin International: China Olympic Garden (3883)Undervalued high-growth developers

Editor's note: recently, the housing stock price has been greatly adjusted with the general trend, while the sales of a number of high-quality real estate companies have repeatedly reached new highs, forming a trend of deviation, and the investment value continues to rise, among which the performance-to-price ratio of rapid growth is particularly prominent. In May, the company announced the signing of a strategic cooperation framework agreement with Henderson.The combination of the strong and the strong. Management has increased its holdings, and Chairman Guo Ziwen has made a big increase in the company's shares every year since 2014, which has continued to increase from 48% in 2014 to 54%, demonstrating management's confidence in the company. In January, March and April 2018, it continues to increase its holdings, and the highest price has reached 7.52 yuan, and the chairman is expected to further increase its holdings in the future.

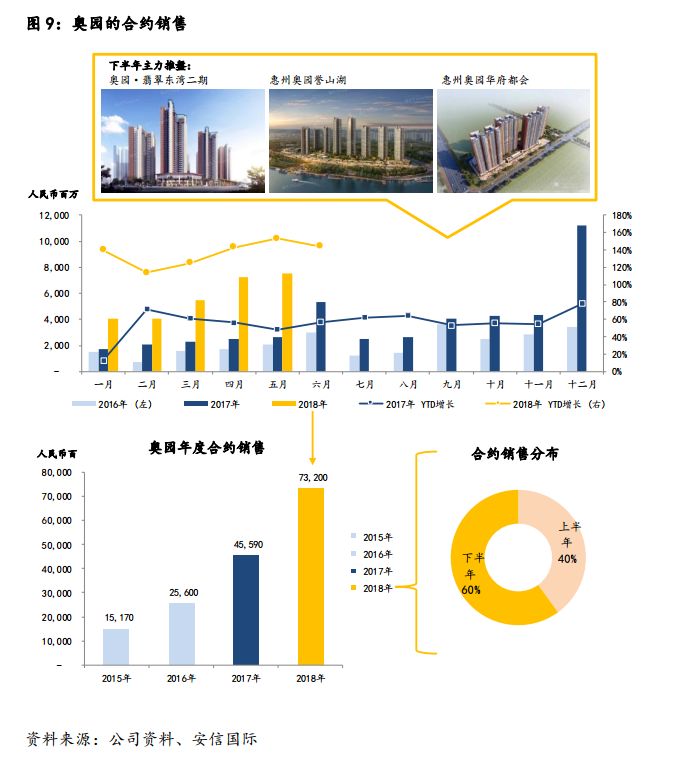

The year-on-year growth doubled in the first half of 2018, and project sales progressed smoothly.

As of June 2018, the company's cumulative contract sales were about 40 billion yuan, an increase of more than 140% over the same period last year, far higher than the national commercial housing sales growth of 12% and the average growth of 44% of the major inner housing enterprises listed in Hong Kong. Taking the marketable resources of 120 billion yuan in 2018 as a consideration, there is little doubt about achieving the annual target of 73 billion yuan in sales. Total sales in 2017-18 will reach 118 billion yuan, calculated on the basis of 80% of the average value of equity and 9% of the net interest rateIt is equivalent to a net profit of 8.5 billion yuan, bringing a profit base for this year and next year.

In the second half of the year, the company will focus on projects such as Shenzhen Olympic Garden, Jade East Bay, and so on. under the high base effect, although the company's sales growth will slow in the second half of the year, it should not be difficult to achieve the annual sales target of 73 billion. Judging from the sales distribution of 40-60 in the past and the second half of the year, the annual sales are expected to exceed the target.

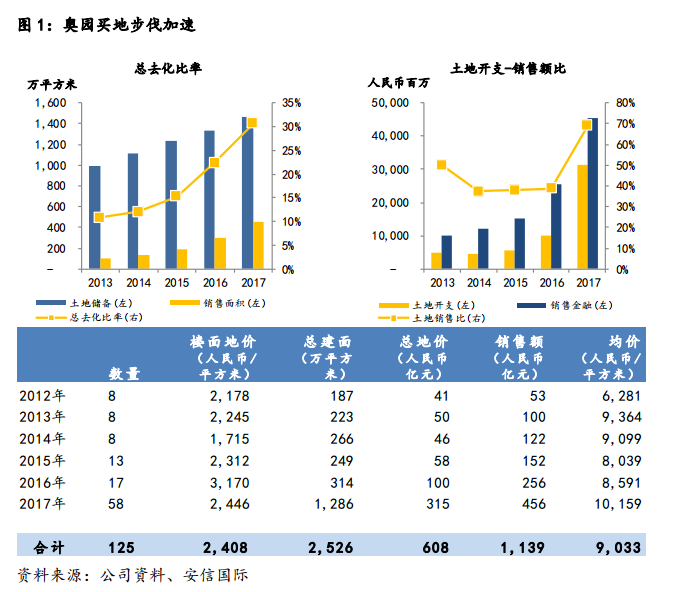

Proficient in mergers and acquisitions, replenishment of land reserves is guaranteed.

By the end of 2017, the company's land storage is 25 million square meters, and the total value of the goods is estimated to be about 250 billion yuan, which is equivalent to about 3.5 times the target sales in 2018. 3.2 billion Hong Kong dollars have been recovered from the "Chang'an 8 incident" since 2012, and the pace of land purchase has accelerated significantly, from 4 billion yuan in 2012 to 31.5 billion yuan in 2017, equivalent to a compound annual growth rate of 50 per cent.

The company has been rooted in the Greater Bay area for many years, and senior executives and project managers fully understand that the company can continue to acquire high-quality land at low prices in southern China in the future, so as to maintain the growth rate of sales. The land acquired by the company through old reforms or mergers and acquisitions accounted for about 80% of the total in 2017.The average cost of soil storage is aboutPer square metre2000 yuan, low-cost land storage has a great advantage in the price-limited environment.。

Olympic Garden is a leader in mergers and acquisitions, accounting for more than 80% of the total new projects in 2017. The merger and acquisition of real estate means that all the shares of the absorbed real estate company are transferred, and all the debts of the enterprise and the resulting risks are borne by the merged company in accordance with the law. Relying on the Olympic Park for many years to establish a good relationship with other small and medium-sized developers, so that the company can smoothly make mergers and acquisitions at a better cost to acquire land.

It has stabilized the South China market, and then carried out the national layout to disperse the regional risk.

In the past, the company focused on the development of the Greater Bay area, but in 2017, the company significantly increased the proportion of new land reserves outside South China, from the original 1 big 3 to 50%. Benefiting from the ability to acquire land at low prices in mergers and acquisitions and old reform projects to reduce the risk of project development, the company added 58 pieces of land in more than 30 cities in 2017, of which 36 pieces of land are located in new cities outside the Greater Bay area. at present, the company's land reserves are more evenly distributed in the region, in the face of regional regulation, risks can be dispersed, development projects from different cities can hedge each other, and the future development will be more stable.

Project follow-up investment plus equity incentive to improve efficiency

In order to control the investment risk of the project and enhance the profitability, the Olympic Garden imitates other enterprises to introduce the "project following investment system". Under the project follow-up mechanism, executives are required to invest personal funds according to the amount invested in each major project, while district managers are also required to invest in the sub-project. The Olympic Park granted a total of 25 million shares to senior executives in July 2018 at an exercise price of HK $5.522 per share, with 50 per cent exercisable in 2019 and the remaining 50 per cent exercisable in the first half of 2020. Equity incentive will stimulate the enthusiasm of management, so as to create performance, so that the rapid growth of the company in the short term has a very great role in promoting. The company granted an option of 10 million shares at an exercise price of HK $1.778 per share at the end of 2016. since then, the company has doubled its earnings and the share price performance is obvious to all.

The market does not fully reflect the high growth of the Olympic Park, reiterating the buying rating.

The Olympic Garden is a developer rooted in southern China, accounting for 2% of Guangzhou in terms of sales and about 1.5% of Guangdong Province as a whole. In addition, good experience in the transformation of old villages and old factories will bring high-quality and low-cost land for the company, all of which lay a good foundation for the future development of the company. In addition, the company acquired a large amount of land in East, Southwest and Central China from 2016 to 17. Under the national layout, the newly acquired land will be released in 2018, and the value of the company's equity is estimated to be 200 billion.

At present, the company has a land reserve of nearly 25 million square meters. It is estimated that the net asset value of the company is 31.6 billion yuan, at a discount of 30%.The new target price is HK $9.80Which is equivalent to a 30% discount on our NAV valuationReiterate the "Buy" rating。

For more wonderful content, please mark: the past period of the rich way research election.