This article is edited from Societe Generale Securities Research News: "Hua Medicine-- A new development platform for innovative drugs for diabetes", "Fangda Holdings-- based on the fast-growing pharmaceutical CRO of China and the United States"

After less than half a year of policy formulation, the wave of listing of unprofitable biotech companies in Hong Kong has begun. As of July 23, eight unprofitable biotech companies have applied to list in Hong Kong, according to Hong Kong Stock Exchange Zhong Innovation. This issue of Futu Research and selection will bring you new shares of Nuggets Medicine.

Hua Medicine: a new development platform for innovative drugs for diabetes.

Hua Medicine, a Chinese drug development company, is currently committed to developing the world's first oral drug Dorzagliatin for the treatment of type 2 diabetes and mGLUR5 for the treatment of levodopa-induced dyskinesia (PD-LID) in Parkinson's disease.

Market pattern:

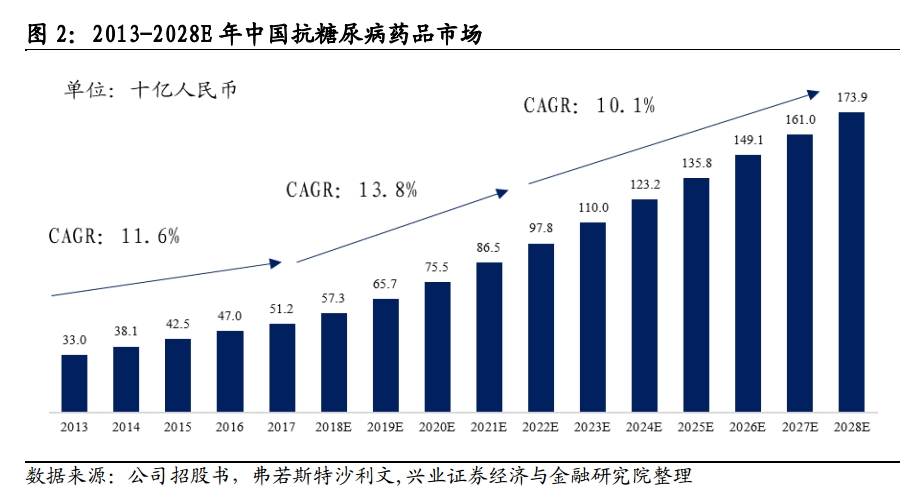

According to Frost Sullivan, the global market for anti-diabetes drugs was $68.9 billion in 2017 and is expected to grow to $90.7 billion in 2022, a compound growth rate of 5.6 per cent.

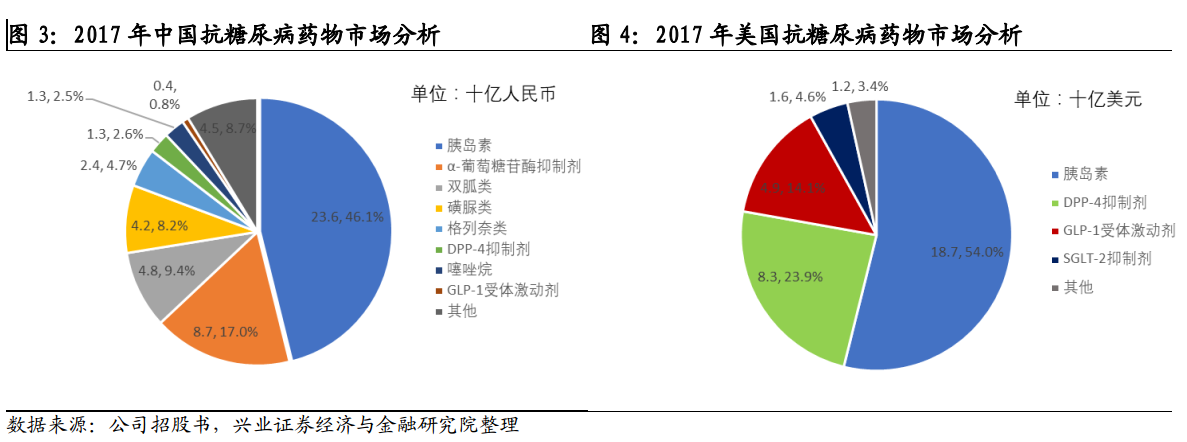

Unlike in the United States, traditional antidiabetic drugs are mainly used in the Chinese market, while innovative drugs such as DPP-4, GLP-1 and SGLT-2 inhibitors have less sales revenue.

Dorzagliatin faces fierce competition between existing drugs and innovative drugs under development. As a mainstream therapeutic drug, metformin is usually well tolerated, has been used for more than 60 years and is relatively cheap. Innovative drugs are currently being developed for more than 20 drugs targeting 8 types of targets.

Competitive advantage:

(1) Phase Dorzagliatin III clinical trial has been approved and is expected to be available in 2020.

Dorzagliatin has two advantages: 1) the curative effect is better than the existing oral drugs. 2) the safety is higher than that of previous GKA drugs.

Because of its good tolerance and low side effects in clinical trials, Dorzagliatin is the first GKA drug to enter clinical III phase. It is expected to be put on the market in 2020 and become the first-line standard therapy for type 2 diabetes in China in the future.

(2) Joint research and development of VIC model to reduce the risk of drug development.

Hua Medicine uses the VIC operation mode of "VC (capital) + IP (technology) + CRO" for drug development. At present, there are 11 suppliers providing clinical trial management, drug manufacturing and analysis support services for the company. Three of the top five suppliers are subsidiaries of Wuxi Apptec New Drug Development Co., Ltd.

(3) the core team has rich experience, and senior executives all have working background in large pharmaceutical companies.

Financial data: the company has a total loss of nearly 1 billion, and its cash flow is sufficient.

Hua Medicine has not yet commercialized his products, has not generated revenue from the sale of goods so far, and has only recognized limited income with government subsidies and bank interest. As of March 31, 2018, the company had 836 million bank balances and cash.

Shareholder background: the world's famous venture capital continues to be optimistic, raising more than 200 million US dollars in 5 years.

The funds raised from this public offering are mainly used for the later research and development and commercialization of Dorzagliatin.

The funds raised from this public offering are mainly used for the later research and development and commercialization of Dorzagliatin.

Fangda Holdings: based on the fast-growing pharmaceutical CRO of China and the United States

Fonda Holdings is a pharmaceutical CRO company that provides integrated, science-driven research, analysis and development services throughout the drug discovery and development process to assist pharmaceutical companies in achieving drug development goals. The company has operations in the United States and China, the two major markets served by global contract research institutions.

Industry pattern:

The global pharmaceutical market, with a size of $1.209 trillion by earnings in 2017, is expected to grow to $1.5966 trillion in 2022, with a compound annual growth rate of 5.7 per cent over the period. According to the size of the market in 2017, the United States and China are the two largest pharmaceutical markets in the world.

With the development of the pharmaceutical industry, specialization and division of labor has become an inevitable trend. Through specialization and economies of scale, CRO can help pharmaceutical companies accelerate project schedules, control risks, optimize resources and reduce costs, thus booming, especially in the two major pharmaceutical markets in China and the United States.

The competition in Chinese and American pharmaceutical CRO market is fierce and the barriers to entry are high. Many large and established multinational contract research institutions can provide a range of services ranging from discovery to commercial release, which can meet the needs of many projects at the same time.

Competitive advantage:

(1) the customer base is diversified and the customer is sticky.

The company has a diverse customer base, including leading pharmaceutical companies such as Janssen, BeiGene and FreseniusKabi in the United States, as well as Yangzijiang Pharmaceutical, Haizheng Pharmaceutical and Green Leaf Pharmaceutical in China. The company provides services to enterprises, academic institutions and research centers of all sizes.

(2) the company has a deep pool of scientific research personnel, experienced and professional management team and world-class facilities and equipment.

Financial data:

Bioanalysis is the largest business of Fangda Holdings, with combined revenue accounting for 50.58% of the total revenue; chemical, manufacturing and control are the company's second largest business, mainly providing services in the United States; and the two businesses carried out in China, bioanalysis and bioequivalence services, showed a trend of rapid growth, increasing by 200% and 203% respectively in 2017 compared with the same period last year.

Shareholder background:

The company's controlling shareholder, Hong Kong Tigermed Technology Co., Ltd. is a wholly owned subsidiary of Hangzhou Tiger. Tigermed Group enjoys a high reputation in the clinical research and development of late stage (II to IV) in China and other countries in the Asia-Pacific region. The relationship with Tigermed Group enables Fangda Holdings to provide customers with comprehensive solutions covering clinical trial support from phase I to IV in China.

The funds raised by Fonda Holdings are mainly used to enhance and expand production capacity and expand the company's range of services to meet the growing demand for services.

Extended reading:The first unit of biotechnology in Hong Kong stock-Golly Pharmaceuticals

For more exciting content, please mark:The past period of the rich way research and election gathered together.