Edited by Guoxin Securities: ant Finance-- from payment tools to Financial Services platform

Introduction: Ant Financial Services Group, who started with Alipay, is growing from a simple payment tool to a comprehensive financial services platform.

Ant Financial Services Group was officially established in October 2014. in July 2015 and April 2016, Ant Financial Services Group announced the completion of round A financing of 12 billion yuan and round B financing of US $4.5 billion. In June this year, Ant Financial Services Group completed the latest round of financing, raising 14 billion US dollars.

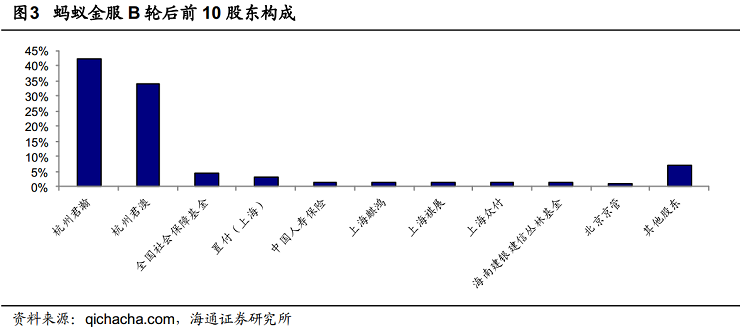

After several rounds of financing, Ant Financial Services Group's shareholders include the National Social Security Fund, China Life Insurance Company Limited, PICC and other national brands, Beijing Financial Management, Shanghai Financial Development Investment Fund and other local funds, as well as the participation of private equity funds such as Shanghai Qihong, Shanghai Qi Zhan, Shanghai Zhongfu and so on.

I. the five major business sectors support the inclusive financial strategy of Ant Financial.

At present, Ant Financial Services Group's inclusive financial business is mainly divided into five parts: payment platform, wealth management, micro-loan business, insurance services, credit system.. Through the payment as the flow entrance, with the credit system as the auxiliary, actively expand wealth management, small and micro loans and insurance business.

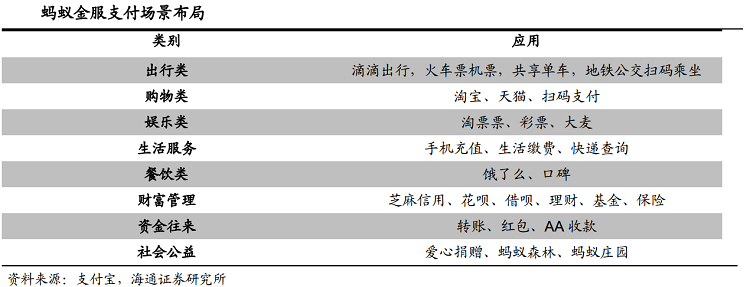

Payment business:Payment business is the largest business in Ant Financial Services Group at present. At present, Ant Financial Services Group has created a multi-dimensional payment scene around the life needs of users: from the QR code payment of supermarket convenience stores to the instant recharge of telephone charges; from the mobile phone purchase of train tickets to DiDi Global Inc. 's secret-free payment for travel.

At present, the duopoly situation is taking shape in the payment market. By the end of 2017, Alipay had 54.26% of the market share for mobile payments, while Wechat had 38.15%. The market share of Alipay and Wechat has become increasingly stable, creating a duopoly in the payment market, while other payment platforms together account for only about 7 per cent of the market.

The domestic third-party payment market is developing rapidly, with a growth rate of more than 20% in each quarter over the previous quarter in the past two years. By the end of 2017, the total payment volume of China's payment market reached 37.7 trillion yuan, an increase of 28 percent over the previous quarter.

Wealth Management:Ant Wealth, an one-stop financial management service platform under Ant Financial Services Group, is building an open platform for full-product financial management including Yu'e Bao, regular period, fund and gold through upgrading. In addition to the well-known Yu'e Bao, Ant Financial Services Group partnered with more than 100 asset management companies as of June 2017 and has more than 2600 fund products.

In April 2015, Ant Financial Services Group invested 199 million to own 60.8% of the company, which was established in 2006. it is one of the first vertical websites of funds for individual investors in China. it is also the first batch of independent fund sales agencies to be qualified by the Securities Regulatory Commission. Join hands with several meters fund to build blocks for Ant Financial Services Group in the field of Internet finance.

Micro-loan business:Ant Financial Services Group's micro-loan business is mainly divided into online merchants and banks for small and micro enterprises and ant borrowing and ant flowers for individual consumers. Ant borrows and ants spend belong to consumer loans, and online merchants banks rely on the online banking platform to issue operating loans; in addition, they also cooperate with banks that are mainly engaged in loans to small and medium-sized enterprises. charge technical service fees and earn interest spreads.

Insurance services:Ant Insurance Service platform cooperates with a number of insurance companies to launch insurance products that meet the needs of individual consumers and small and micro businesses.

At the same time, the ant insurance service platform combines artificial intelligence, blockchain and other high-tech means to help insurance companies upgrade better, and dig more in-depth cooperation with insurance institutions, such as blockchain technology to accurately help the poor, image recognition technology to improve claims and so on.Ant insurance service platform has reached cooperation with many insurance companies such as Zhongan Insurance, Cathay Pacific property Insurance and Xinmei Life Insurance.According to investor disclosure day data in 2017, the Ant Insurance service platform currently has 392 million active users, compared with its target Ping an Insurance, which has 131 million active users. The per capita premium has increased by 43 per cent compared with the same period last year.

Sesame credit:Most of the credit data of the credit information center of the people's Bank of China are based on users' personal loan records and credit card use records, and the scope of data records is narrow. The emergence of sesame credit, the use of traditional data and the Internet big data, can be more efficient, flexible and accurate analysis of users' personal credit information. Sesame Credit not only uses users' transaction data when using Alipay, but also uses users to pay living expenses such as water, electricity, coal and Credit Card Repayment through Alipay to depict users' credit information in a more three-dimensional way.

Second, make use of financial technology to innovate financial services

Ant Financial Services Group has developed around the four-tier architecture of connection, credit, risk control and basic technology in recent years. The connection ability opens up the channel between consumers and financial institutions; the credit ability helps users to avoid various repetitive and tedious processes; the risk control ability ensures the safe and stable operation of the whole platform system; and the basic technology, it is the cornerstone of the above three capabilities, supporting the realization of various applications.

Ant Financial Services Group CTO Cheng Li proposed the BASIC strategy at the Cloud Conference. Ant Financial Services Group technically focused on five basic areas: blockchain (Blockchain), artificial intelligence (AI), security (Security), Internet of things (loT) and cloud computing (Cloud Computing).

Third, go out to sea and successfully lay out overseas

With Peng Lei's departure from Ant Financial Services Group to become chairman of Lazada, and BABA's additional $2 billion investment in Lazada on March 19, BABA continues to invest new bargaining chips in its international strategy. At the pace of Ant Financial Services Group's international expansion, there are both global merchant payment systems based on the growth of Chinese outbound tourists and overseas local wallets designed to serve locals.

Since 2015, Ant Financial Services Group has started to find local partners overseas and develop overseas local wallets by exporting technology at the same time. At present, Alipay's overseas wallet partners have expanded to 9, including India, Thailand, the Philippines, South Korea, Indonesia, Hong Kong, China, Malaysia, Pakistan and Bangladesh. The nine companies are mainly located in East Asia, Southeast Asia and South Asia around China, forming a "91st" mobile payment network with Chinese mainland market, covering about 3.6 billion people, accounting for nearly half of the world's population.

Fourth, Ant Financial Services Group's profitability and market capitalization

According to BABA's financial report, Ant Financial Services Group's profit-sharing income grew rapidly in 2017, with 7.89,19.66,19.95 and 196 million yuan respectively in the four quarters. According to the proportion of 37.5%, Ant Financial Services Group's pre-tax profit for each quarter is expected to be 21.04,52.43,53.20 and 530 million yuan.The pre-tax profit for 2017 was 13.189 billion yuan, an increase of 354% over the same period last year.。

We believe that Ant Financial Services Group will become the largest financial technology start-up in the world, and its market capitalization will catch up with that of PayPal Holdings Inc. At present, the global market is more optimistic about Internet technology companies, giving a higher valuation.

For more wonderful content, please mark: the past period of the rich way research election.