Edited by Haitong: why do A-share American stocks have both ice and fire?

Under the trade war, why?A shares have fallen endlessly, but US stocks have performed more steadily, with the Nasdaq even hitting new highs?

1. American stocks in A shares are both hot and icy.

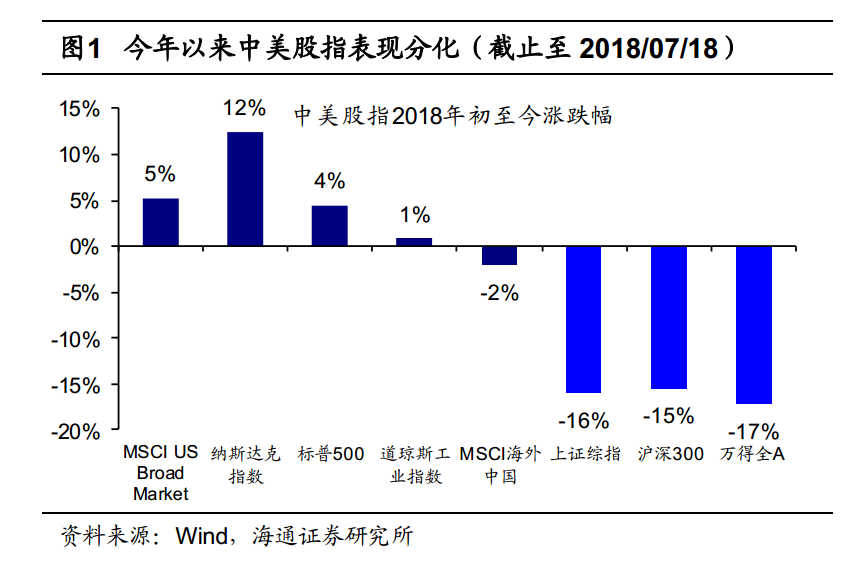

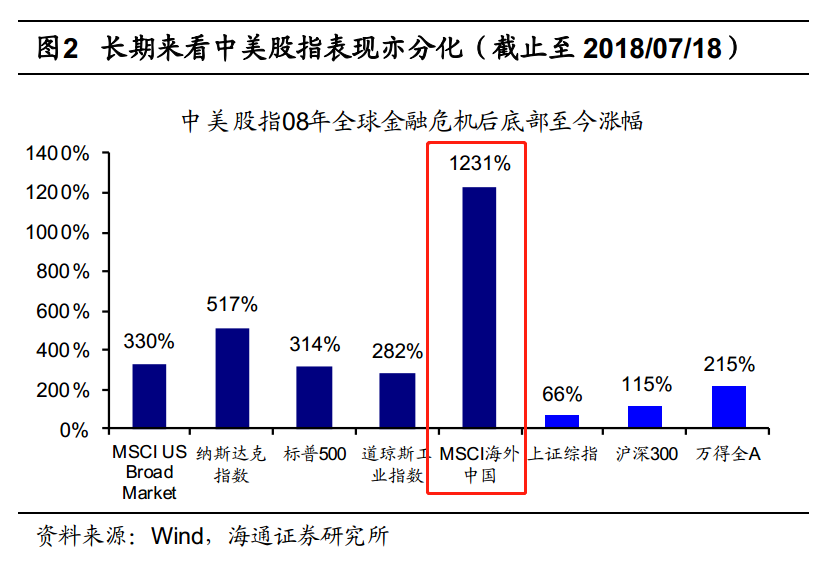

The stock markets of China and the United States have been divided since the beginning of this year, as of 2018-07-18.The three major US stock indexes, the NASDAQ, the S & P 500 and the Dow Jones Industrial average, have risen 12 per cent, 4 per cent and 1 per cent respectively over the past 18 years, compared with 16 per cent for the Shanghai Composite Index, 15 per cent for the CSI 300 and 17 per cent for Wande A.Stretching the timeline to 10 years, based on the post-2008 financial crisis, the Nasdaq, S & P 500 and Dow Jones industrials have risen 517%, 314% and 282%, respectively, while the Shanghai Composite Index, CSI 300 and Wande A have risen only 66%, 115% and 215%, much lower than the US stock index.It is a long-term phenomenon that A shares underperform US stocks.

2. the trend of A-share US stock index is divided, which has nothing to do with the fundamentals.

In terms of GDP, China's real GDP grew at an average annual rate of 11 per cent over the past decade, much higher than the US's 2 per cent, while all A-share net profits grew at an annualised rate of 8 per cent year-on-year, much higher than US stocks'1 per cent.The reason for the poor performance of A shares is that A shares do not enjoy valuations that match the fundamentals.. Since 2008, the average PE (TTM, the same below) of the S & P 500 is 18, while the PE of the Shanghai Composite Index is 16. The rise of the Sino-US stock index has two remarkable characteristics: one is that the rise of US stocks for many years mainly comes from the rise of heavyweights, and most of the gains of heavyweights are mainly due to high valuations. Second, Chinese stocks listed in the United States have risen much more than those listed in A shares:The MSCI overseas China index (99 per cent weighted by US-listed US-listed Chinese stocks) has risen 1235 per cent since the bottom of 2008, far outpacing the three major indices of US stocks and the three major A-share indices.

3. The performance differentiation of A-share US stock index is partly due to the differences between index compilation methods and weighted stocks.

First, the Shanghai Composite Index is compiled using the total market capitalization weighted average method, which makes the performance of the Shanghai Composite Index greatly affected by large-cap stocks. As of 2018-07-18, the total market capitalization of bank stocks, Petrochina Company Limited and China Petroleum & Chemical Corp in the Shanghai Composite Index was as high as 75%. Second, the Shanghai Composite Index only includes stocks listed on the Shanghai Stock Exchange, while those on the Shenzhen Stock Exchange are not included. According to historical data, the Shenzhen Composite Index has risen 247% since the bottom of the global financial crisis in 2008, far exceeding the Shanghai Composite Index.

4. The performance differentiation of A-share US stock index mainly comes from the problems of A-share system.

Problem 1: listed companies have not survived the fittest.

On the one hand, it is not "superior":The listing standards of A-shares are relatively stringent, and many innovative companies can only go to the United States to list. The more stringent listing system distorts the market capitalization and profit industry structure of A shares.Among the Chinese stocks in the United States, technology stocks and consumer stocks account for 72% of market capitalization and 60% of profits, much higher than 35% and 14% of A shares.Enterprises representing the new economy, such as BABA, Baidu, Inc., JD.com and Trip.com, were unable to list in A-shares because of losses in the early stage. if they had been listed in A-shares, the industry structure of the CSI would be more reasonable.

On the other hand, there is no "elimination of the inferior":In addition to the leakage of blue chip stocks from A shares, most of the existing poor performance stocks can not be delisted from A shares, which also lowers the overall target quality of A shares. Because the delisting system is not perfect, most of the poor performance stocks cannot be delisted from A shares.In the past five years, the delisting rate of US stocks was 6.3 per cent, while that of A shares was 0.3 per cent.At present, the listing system and delisting system of our country are constantly improving.

Problem 2: the proportion of institutional investors is low, and heavyweights do not fully enjoy the valuation premium.

American institutional investors are dominant and are happy to give higher valuations to heavyweights.

The median PEG of the top 10 weighted stocks in the S & P 500 over the past decade was 2.5, higher than that of the Shanghai and Shenzhen 300s.It can be seen that US stocks have given higher valuations to leading stocks for the growth rate of earnings per unit. The main reason for the premium enjoyed by the leader is the high proportion of institutional investors in US stocks. As of 2017In US stocks, institutional investors account for 90% of the market capitalization, while A-share institutional investors account for only 24% of the market capitalization.China is actively guiding pension, foreign capital and other long-term funds into the market to train institutional investors.

The proportion of A-share institutional investors is low, and heavyweight stocks do not enjoy the premium.

AAlthough the leading stocks have better fundamentals than their counterparts in US stocks, the market does not give them higher valuations.Compared to being a leader in alcohol, Guizhou Moutai's 18-year net profit growth is expected to be 34% (Wind consensus forecast, A-share same below), 18-year PEG is 0.9, while Diageo PLC's 18-year net profit growth rate is expected to be 7% (Bloomberg consensus forecast, US stock is the same below), corresponding to PEG of 3.6; as a home appliance leader, Whirlpool's 18-year net profit growth rate is expected to be 14%, corresponding to PEG of 2.6%, while Gree's growth rate is 22%.

For more wonderful content, please mark: the past period of the rich way research election.