Edited by Haitong: going out to sea to open up a new space for the growth of domestic game companies

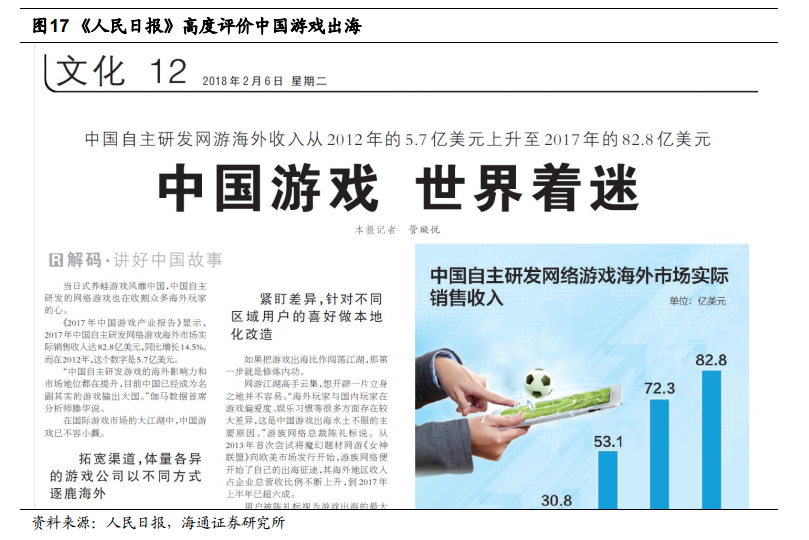

With the gradual fading of the demographic dividend in the game market, the domestic game market has become white-hot. Tencent, NetEase, Inc and other game giants have accelerated the layout of games out to sea. "People's Daily" spoke highly of the excellent performance of Chinese games going out to sea under the title of "fascinated by the Chinese Game World."

Domestic: demographic dividend recedes, competition for buying intensifies

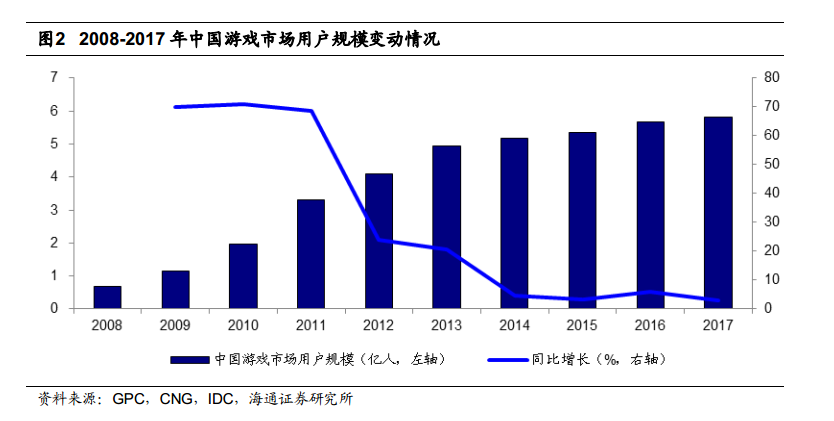

In 2017, the sales revenue of China's game market reached 203.61 billion yuan, an increase of 23.0 percent over the same period last year, and the ARPU value reached 349.2 yuan, an increase of 19.4 percent over the same period last year.The number of users in China's game market reached 583 million in 2017, an increase of only 3.1 percent over the same period last year, and the user growth rate has maintained single digits for four consecutive years, indicating that the number of domestic game users has become saturated.With the gradual decline of the demographic dividend in the game market, the expansion of the market scale has evolved from the original "two-wheel drive" model of "incremental users + payment promotion" to the current mainly relying on the improvement of payment level.

In addition to Tencent, if other domestic game manufacturers want to stand out in the fierce market competition, they generally adopt the method of "buying quantity" (that is, buying advertising space in Internet media with traffic) for marketing and promotion.。In 2017, less than 1% of games were activated by buying more than 1 million times, and the vast majority of game purchases were not effective in marketing, with less than 100,000 new activations.

Overseas: domestic game manufacturers are growing rapidly, and there is a bright future for overseas competition.

According to New Zoo, global game revenue was $121.7 billion in 2017, an increase of 14.3% over the same period last year, and the global game market will reach $180.1 billion by 2020.Although China has overtaken the United States to become the world's largest game market, its market share is only 25% of the global game market.

In addition, although game revenue in the Asia-Pacific region accounted for nearly half of the global market in 2017, the level of payment by players is low.In 2017, the ARPU value of the Asia-Pacific game market was only $44.72, less than half of that in Western Europe ($100,000,000) and 1/3 in North America ($150,000,000). Users in developed countries are more willing and able to payIf we can successfully enter the game market in developed countries, it will effectively promote the income growth of domestic game manufacturers.

According to New Zoo, among the top 25 companies by global revenue in 2017Domestic companies Tencent, NetEase, Inc, Perfect World and Sanqi Mutual Entertainment are on the list, with Tencent and NetEase, Inc ranking first and sixth respectively in the global income rankings.

New trend of game going out to sea: Teng.com accelerates entry, the region is from near to far, and a hundred flowers blossom in all categories.

In recent years, the sales revenue of China's independent R & D online games in the overseas market has continued to grow. In 2017, the revenue of games going to sea reached 8.28 billion US dollars, an increase of 14.5 percent over the same period last year, with a compound growth rate of 46 percent in the past five years.2018Q1 Tencent and NetEase, Inc have an astonishing 90% market share in the mobile game market, and the top 10 games in revenue are basically dominated by NetEase, Inc and Tencent, with obvious upward ceilings.

From a regional point of view, the overseas territory of domestic game manufacturers is gradually expanding, starting from Southeast Asia to Europe and the United States.In the first half of 2017, the income growth of Chinese mobile games in the United States, Canada, France, Britain and other western developed countries exceeded 60%.It shows that China's games have made great progress in Europe and the United States. Category is no longer limited to the more mature traditional categories such as RPG and SLG, but also shows a state of letting a hundred flowers blossom in the subdivided fields such as Quadratic and MOBA. With the continuous realization of Battle Royale Mobile Games in 2018, this category will also become a new growth point of overseas game revenue.

The impact of the game going to sea: it may have a double improvement on the company's performance and valuation.

On the one hand, the game has opened up a new incremental market, and the performance of the sea game company is expected to be greatly improved. On the other hand, the game going out to sea is expected to enhance the product recognition and the brand value of the company, and then enhance the valuation of listed companies.NetEase, Inc has a long-term valuation discount relative to Blizzard and other major European and American game companies, but after the popularity of overseas Battle Royale Games, dynamic PE has increased significantly, indicating the improvement of capital market investors' awareness of high-quality game companies.

Recommended target: it is recommended to pay attention to the two major domestic game leaders Tencent and NetEase, Inc

Tencent's self-developed games such as "PUBG:Mobile" gradually capture overseas markets; NetEase, Inc "Onmyoji" is widely praised in Japan and South Korea, and "Wild Action" has gradually become a Japanese national game. In addition, recommend domestic and overseas game manufacturers: Baotong Technology (China News reports that net profit will increase by 30% and 60% compared with the same period last year. Executives have recently increased their holdings and buybacks many times to show long-term business confidence.), Chinese media ("dispute among Kings" has entered a mature stage, and products such as "Love and producer" and "Total War" are expected to be launched in the second half of the year). And the second-tier leader of the game that is gradually moving towards globalization: Sanqi Mutual Entertainment (excellent products such as "Chu Liuxiang" and "God without Moon" will be released overseas in the second half of the year), wandering network (overseas game income surpasses that of domestic, accelerating card position overseas market), focus on Century Huatong (its Funplus ranks first among Chinese APP publishers in terms of overseas income for three months in a row). Hong Kong stocks are concerned about IGG (its strategic mobile game "Kingdom era" has performed strongly overseas).

For more wonderful content, please mark: the past period of the rich way research election.