Fine editing from CITIC: the wave of buyback and increase is expected to stabilize market sentiment.

Buffett once said, "buybacks are the best market capitalization management, and buybacks have more reference value for the operation and stock price of companies, especially large companies." Recently, A shares and H shares have plummeted, but a wave of corporate buybacks and increased holdings of major shareholders have emerged: a shares include Midea, focus Media, and so on. A number of listed real estate companies, including Country Garden Holdings and China Evergrande Group, have frequently announced heavy buybacks or increased holdings of their own shares, which has become the focus of the market.

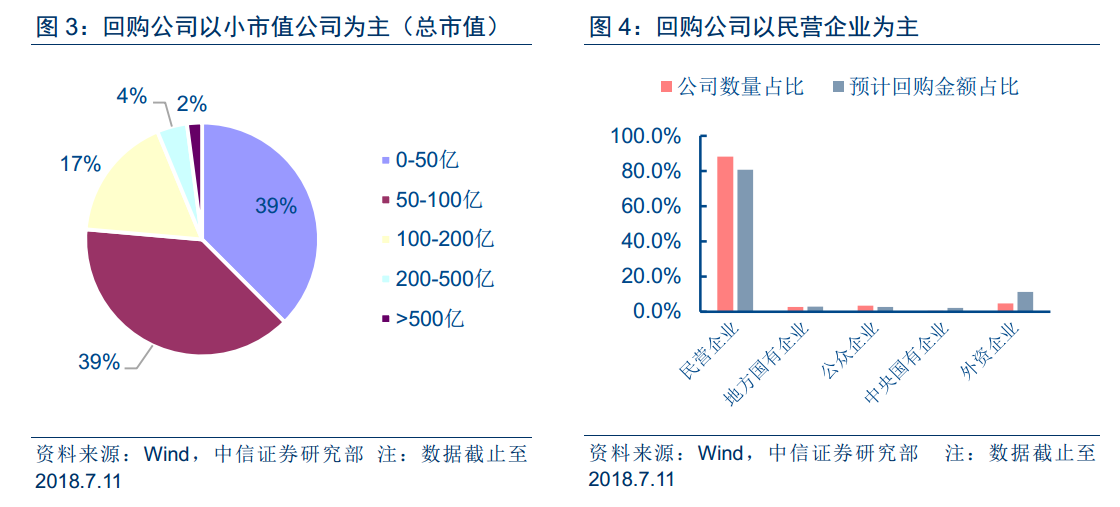

Stock buyback: mainly private enterprises with small market capitalization

As of July 11, 2018, the number of A-share repurchase companies has reached 340, with a repurchase amount of 14.38 billion yuan, which has far exceeded the buyback amount for the whole of last year.Excluding the buyback reasons for "equity incentive cancellation", "profit compensation" and other stocks, and select a total of 144 stock pools with similar intentions, such as "enhancing investor confidence" and "promoting the company's stock market price to reasonably return to the company's long-term intrinsic value".Judging from the results after screening, this wave of repurchase is mainly small market capitalization private enterprises, of which companies with market capitalization less than 10 billion account for about 77%, private enterprises account for 88.2%, and private enterprises account for 80.9% of the estimated repurchase amount.

Judging from the screened stock poolThe industry with the largest number of buyback plans issued is the basic chemical industry.A total of 19 basic chemical enterprises have issued buyback plans this yearThe industries with the highest expected repurchase amount are automobiles, home appliances, media, basic chemicals and pharmaceuticals.The corresponding expected repurchase amounts are about 5.53 billion, 4.9 billion, 4.75 billion, 4.66 billion and 2.51 billion respectively.Midea has become the most important factor driving up the estimated repurchase amount in the home appliance industry.

Increase of shareholders' holdings: the overall net change is reduced by 31 billion yuan, and the scale of increase of real estate stocks ranks first.

In history, the net change direction of the increase or decrease of important A-share shareholders is negatively correlated with the trend of the CSI 300 index.When the net change direction is the increase of holdings, it generally corresponds to the periodic low point of the index, especially after the "stock market crash" in 2015.Since the beginning of the year, the net change direction of A-share important shareholders in the secondary market is 52.1%, 45.3% and 2.6%, respectively, and the overall net change is 31 billion yuan.

Real estate stocks fell sharply in the early period, with the net increase of important shareholders in the forefront.Taking the net direction of change as the sample, the mechanical, chemical and pharmaceutical industries have the largest number, with 83, 73 and 64 respectively. The industries with the highest reference market capitalization for net increase are real estate, electronics, power and public utilities.

Vertical overview of industry valuation

As of July 11, 2018, industries with dynamic PE valuations higher than the historical average include national defense, medicine, and food and beverage.

From the perspective of price-to-book PB (LF)At present, the only industry where PB valuation is higher than the historical average is food and beverage.The current PB valuation levels of the rest of CITIC's first-tier industries are lower than the historical average.

From the perspective of valuation deviationFood and beverage is the only industry where dynamic PE and PB valuations are higher than the historical average.The valuation levels of dynamic PE and PB in most industries are lower than the historical average.

For more wonderful content, please mark: the past period of the rich way research election.