The writer is an analyst (Isak Hirsch) from seekingalpha

The rise of trade led to the fall of JD.com 's share price.

In the past few weeks, although JD.com 's share price has fallen by as much as 14%JD.com is likely to be affected by a full-scale trade war only in the short term, and long-term investors can see this as an investment opportunity.. If the trade war escalates, the appreciation of the dollar against the yuan is likely to continue. It is mainly due to the following two points:

1. Different from the general environment in China, JD.com is an e-commerce enterprise that sells purely imported goods. This means that its imports are larger than its exports, so a weaker currency means that imports will become more expensive. The crux of the question is how much of JD.com 's sales come from imported goods. According to its e-commerce website, interviews and research reports, imports totaled $2 billion, accounting for about 25 per cent of total sales. JD.com has a 25 per cent market share and his revenue is almost the same as total cross-border ecommerce sales ($74.68 billion vs $76.4 billion). As a result, the appreciation of the dollar will not have any significant impact on its income, although it may pull down profit margins.

2. The second reason is currency risk. In the case of the dollar, for example, if the conflict does not ease, the dollar will continue to rise against the renminbi, and American depositary receipts, a transferable certificate issued by American commercial banks to assist in the trading of foreign securities in the United States, will depreciate. The rebound of the dollar against the yuan will devalue the yuan against the dollar. If the conflict continues to escalate, the ratio of this pair of foreign exchange portfolios can easily rise to 7 or more. In other words, the stock will depreciate by 7%. So it is also a small risk, at least for all long-term investors, because in the long run, people are optimistic about the renminbi (most predict that China's economy will surpass that of the US by 2050).

Consumption trend

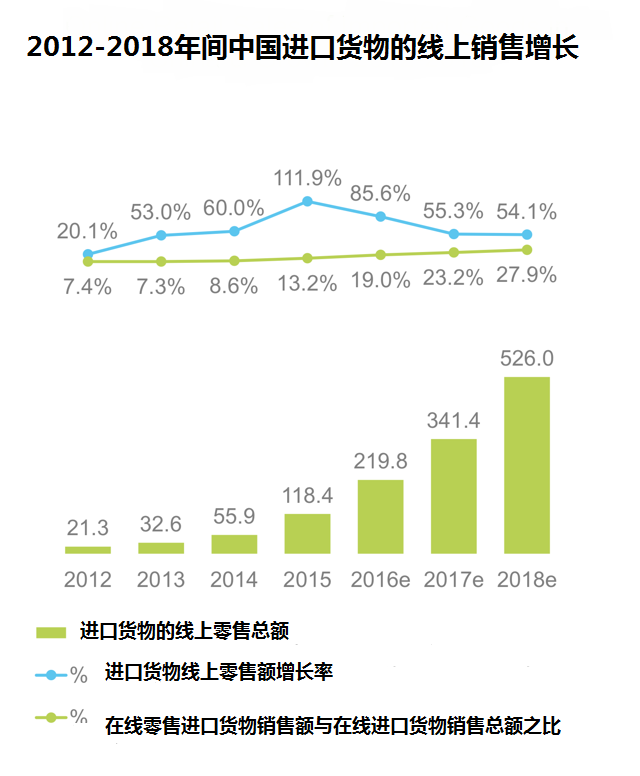

With the growing middle class, cross-border e-commerce is developing rapidly in China. The improvement of living standards in China has made foreign products more popular.

Source: iResearch

Import sales have grown rapidly since the government loosened its grip on online retailing in 2014. Richard Liu, chief executive of JD.com, estimates that within five to 10 years, half of e-commerce in China's big cities will be imported. This growth has made a great contribution to the overall growth of e-commerce in China. As imports become more expensive, this growth will be threatened in a trade war, and the popularity of US products may also be affected. In addition, the Chinese government may advise consumers not to buy American products.

American meat products are especially popular in China. Last year, JD.com announced that he would buy $1.2 billion worth of American beef and pork over the next three years. On July 6, the deal will be hit by China's first wave of tariffs totaling $3.4 billion, including American farmers, Mr Trump's main supporters.

Interest rate hidden danger

Exchange rate risk and tariffs on American products will hurt one of JD.com 's biggest strengths-profit margins. JD.com 's profit margin is very low, if the cost increases, the profit margin will soon become negative. This will be a further drag on share prices, while bears say JD.com will never make a profit. For any long-term investor, however, profit margins are not the determining factor. At present, JD.com 's only concern is income and market growth. Profit margins are not a major consideration until the company matures and reaches its full market potential.

The expansion plan is blocked.

The trade conflict delayed JD.com 's plans to expand into the United States in the second half of 2018. In his partnership with Walmart Inc (Walmart) and Alphabet Inc-CL C (Google), Liu Qiangdong has ambitious expansion plans for the US, which will now have to be suspended. In the current situation, the risk of entering the United States is too great, and JD.com 's long-term vision of becoming a global e-commerce leader will be postponed.

On the other hand, Trump plans to restrict Chinese companies' access to invest in US technology companies, arguing that the move will lead to intellectual property issues. This is even more worrying for Chinese tech giants such as BABA and Tencent. The two giants have recently invested a lot of money in US science and technology. In contrast, JD.com does not invest much in foreign companies, usually in logistics or commercial companies, so it has little impact on JD.com.

Opportunities and challenges coexist

Now it is time for both opportunities and challenges. Historical experience shows that Liu Qiangdong is a person who is good at seizing opportunities. In 2003, the SARS crisis hit China, killing 774 people, causing widespread panic and keeping consumers at home. Liu Qiangdong noticed the higher demand for e-commerce and decided to enter the industry. A year later, JD.com was founded.

Now, the trade war between the United States and the rest of the world has a huge impact. However, this could improve China-EU relations. Amazon.Com Inc may encounter difficulties in the process of expansion, bringing real competitive opportunities to JD.com. The European e-commerce industry is still very fragmented. Amazon.Com Inc has only 13% market share in the UK, Europe's largest e-commerce market. JD.com has invested heavily in Europe and plans to expand the logistics network. The recent Alphabet Inc-CL C partnership gives JD.com an unprecedented opportunity.

The threat of economic cycle

Analysts are worried about the impact of the trade war on the economy, especially China's economy. China's stock market entered a bear market earlier this week, and the Chinese economy is at risk of slowing after a decade of strong growth. Most people believe that the current stage is in the late stages of the market cycle. When the economy is in recession, JD.com will also be hit. However, the technology industry tends to perform poorly in recessions (see chart below), and JD.com may be hit harder than the market as a whole. In addition, growth companies are usually hit because profit margins tend to be negative. If the trade war continues and escalates, a recession is likely to occur in the next 12 to 16 months.

(source: Fidelity Investments (AART))

JD.com 's share price has fallen and has been depressed for some time, and it is down 13% from when Alphabet Inc-CL C's cooperation plan was announced on June 18. As tensions escalate, more negative effects will emerge. However, the war is unlikely to turn into a protracted trade war. Because Trump understands that it will hurt the US economy and his chances of being re-elected. China has also made it clear that it intends to avoid a trade war because the impact on its economy will be devastating. Any compromise made by either side can end the conflict.

As a result, the fall in JD.com 's share price may be short-term and may lead to an excellent time to buy the stock. Most investors believe that many of the risks are over, so there should be gains in the short term if tensions between the US and China ease.

The stock is already ridiculously low, with a price-to-earnings ratio of less than 1 and strong revenue growth. Therefore, although JD.com has short-term downside risks, it will actually have a bright future, and the stock price will be very attractive.

(this article is produced by Futu Information compilation team, compiled / Ma Zhengyang, proofread / Zhu Tianan)