This article is edited by Haitong: underwriting profits are concentrated, non-car insurance business is rising, and the leading company ROE will be promoted.

China's property insurance industry is in a dividend period of high growth and high ROE, and the underwriting profits of the industry are concentrated to the leading companies. PICC Property and Casualty's share price is only 1.07 times 2018PB, which is at an all-time low.

1. The property insurance industry in developed countries has already entered a mature stage, and the general fluctuation range of ROE is 5-10%.

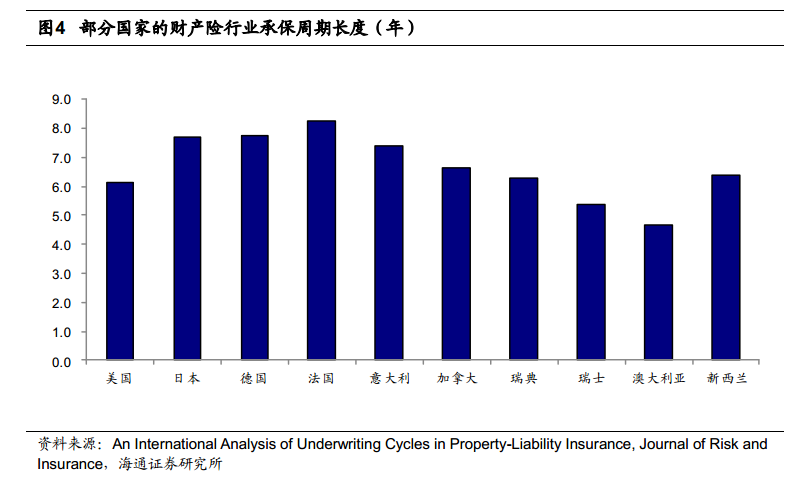

The underwriting periodicity of property insurance is significant, the cycle length is generally 5-8 years, and the "hard market" and "soft market" appear alternately. The hard market "shows strict regulation, while the soft market" is the opposite. The global property insurance business structure is stable, with car insurance, fire insurance, property insurance and liability insurance accounting for 44%, 23% and 15% respectively in 2016.

2. China's property insurance industry is still in a dividend period of high growth and high ROE, and underwriting profits are concentrated to the leading companies.

China's property insurance premiums grew at an average annual compound rate of 21% from 1980 to 2017, making it one of the fastest growing markets in the world. It is expected that non-auto insurance business will enter a period of rapid growth from 2017, which will drive the growth of property insurance premiums at around 15% in the next 3-5 years.The ROE of PICC Property and Casualty and Ping an property Insurance, the two major leaders of China's property insurance industry, have been stable at more than 15% for a long time, of which the ROE of Ping an property Insurance was higher than 20% in 2014-2017, significantly higher than that of their international counterparts.

3. The Matthew effect of car insurance is deepened, and the leading company holds the absolute initiative.

Under the general trend of fee reform, differentiation, science and technology, and scale become the key elements of auto insurance underwriting profits, and PICC Property and Casualty and Ping an property insurance have the absolute initiative.

Leading companies have rich customer accumulation and technology accumulation, historical data and risk control model can bring more accurate screening and management of high-quality policyholders, strong claim payment control ability, and the advantage of compensation rate will be further expanded.

The leading company has a wide range of network layout, deep into the county and rural areas, and outstanding offline and 020 service capabilities, which can give full play to the brand advantages and further enhance the market share.

The leading company has strong control over the auto insurance service chain, which can control the price of spare parts within a reasonable range and reduce operating costs and expense rates.

Small and medium-sized companies generally underwrite losses, it is difficult to initiate cost competition under threshold supervision and other forms of supervision, and leading companies have the initiative in market strategy.

4. Liability insurance, credit guarantee insurance, agricultural insurance, accident and health insurance and other non-car insurance have great potential for growth.

The proportion of premiums of liability insurance, credit guarantee insurance, agricultural insurance, accident and health insurance showed a long-term upward trend, and the proportion of premiums in 2016 was still only 4%, 4%, 5% and 6%, respectively, accounting for about 20%. It is expected that these four businesses will become the new driving force of property insurance premium growth in the future. In the global property insurance premium structure, liability insurance accounts for 15%, much higher than China's 4%. We expect that as the proportion of car insurance decreases year by year, liability insurance and other "developing insurance" with low market penetration will become more and more important. PICC Property and Casualty and Ping an property Insurance have unique advantages in agricultural insurance and credit guarantee insurance respectively.

5. Pay attention to PICC Property and Casualty, the leading company of undervalued property insurance.

On June 29, 2018, PICC Property and Casualty's H-share price was only 1.07 times 2018PB, an all-time low.

For more wonderful content, please mark: the past period of the rich way research election.