This article is edited from Guoxin Securities: ten essays on Market thinking which stocks perform best in the previous A-share sharp falls and rebounds?

From the historical trend of A shares in the past decade, when there is a substantial adjustment in the early stage, the stock market tends to rebound rapidly in a relatively short period of time. The small market capitalization and overfall of the stocks led by the rebound are obvious.

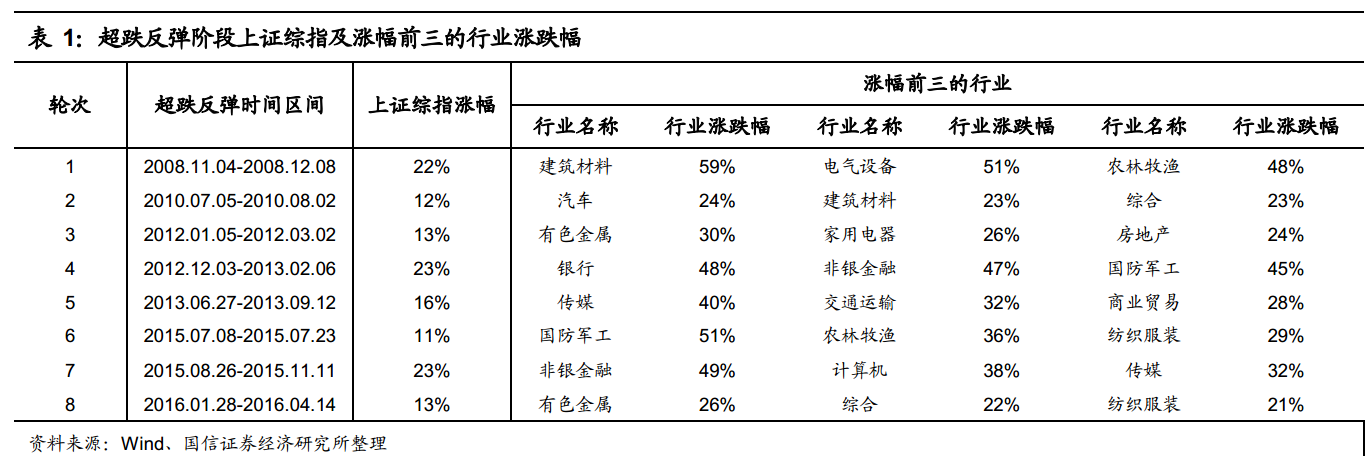

1. The A shares have fallen and rebounded eight times since the financial crisis.

Since the financial crisis in 2008, A shares have roughly fallen and rebounded eight times.The rebound time is about 1 month to 2 months, and the average rebound rate of the index is about 17%.

2. From the perspective of industry distribution: there is no obvious consistent law for the industries that have risen a lot in the previous sharp falls and rebounds.

After the four trillion yuan policy in 2008, the fund sector such as building materials performed better, the banking sector performed best because of the improvement of PMI at the end of 2012, and the media stocks rebounded most strongly after the cash crunch in 2013, and so on.

3. From the perspective of financial indicators, small market capitalization companies rebound strongly, while ROE and valuation have little impact.

Under the market capitalization grouping of all A shares, the performance of small cap stocks in the rebound phase is better than that of companies with larger market capitalization.If we take the profit level and valuation of listed companies as the criteria for classification, the market performance of each group of companies in the oversell-rebound stage has no obvious rule.

4. From the early market performance, the reversal effect is significant, and overfall is the biggest driving force for the rebound.

SpatiallyThe companies with a larger decline in the previous period increased more during the rebound phase.And significantly higher than the previous performance of better companies, that is, the reversal effect.In terms of time, the more the combination falls in a short period of time, the stronger the rebound.

For more wonderful content, please mark: the past period of the rich way research election.

For more wonderful content, please mark: the past period of the rich way research election.