Edited by Everbright Securities: at this moment, how to look at the RMB exchange rate? & GF Securities Co., LTD.: what is the impact of RMB depreciation?

On Friday, the people's Bank of China set the yuan's midpoint rate against the dollar at 6.6166, the eighth day in a row and down 206points from the previous day, falling to its lowest level since December 13, 2017. Analysts believe that compared with 2015, the devaluation of the renminbi in 2018 will have a limited impact on the stock market.

1. Why the RMB depreciates against the US dollar

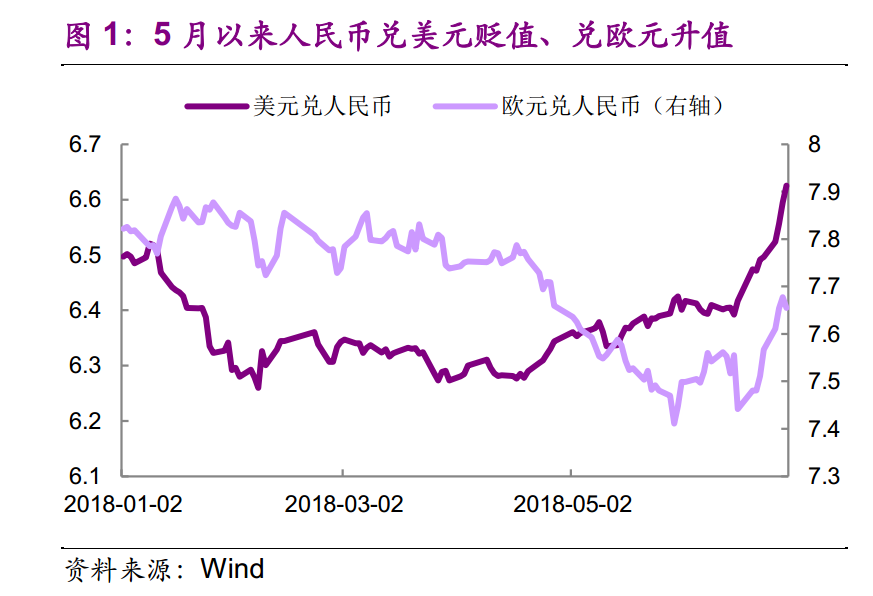

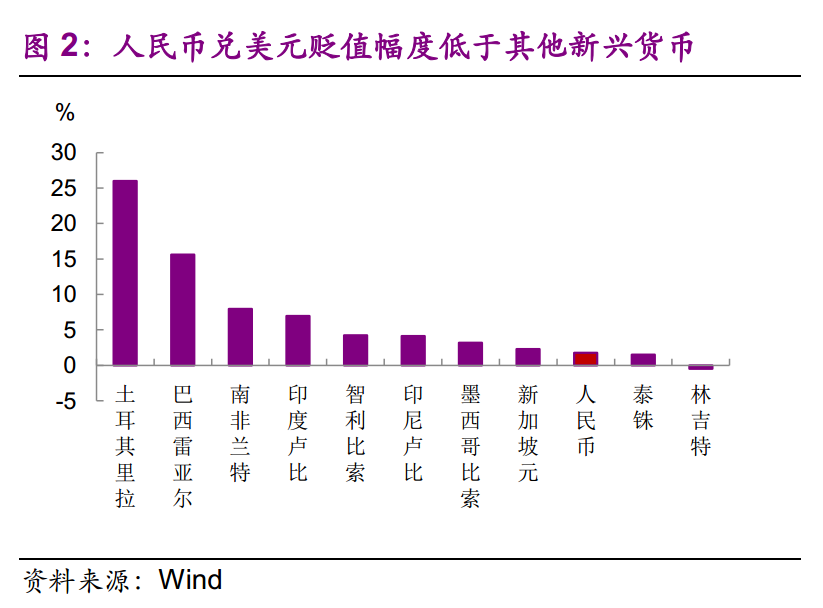

The main reason is the strength of the dollar itself, not the weakness of the renminbi itself.Since May, the dollar index has risen from 90 to 95 and the renminbi has depreciated from 6.3 to 6.6 against the dollar, but the renminbi has appreciated slightly against the euro, suggesting that the weakening of the renminbi is mainly due to the appreciation of the dollar. The renminbi has depreciated less than other emerging market currencies, leaving it appreciating slightly against a basket of currencies (the CFETS renminbi exchange rate index rose 2.6 per cent in the first half of the year).

The secondary reason is that China's economy is still likely to decline in the short term, and the signs of monetary policy deviation between China and the United States seem to be clearer.The new rules on asset management and the regulation of local government debt have led to sluggish year-on-year growth in social finance and M2, and a sharp decline in infrastructure investment. The credit risk of local city investment platform rises, the default events of manufacturing enterprises are heard from time to time, and the market risk preference decreases. On June 24, the central bank announced that it would reduce deposit reserves by 0.5 percent and release about 700 billion yuan, indicating that monetary policy is more neutral and loose. At the same time, the Fed's interest rate meeting in June was more hawkish on monetary policy, with China and the US deviating from monetary policy, putting pressure on the renminbi exchange rate.

The recent devaluation of the RMB is not directly related to Sino-US trade frictions, and there is still room for the dollar index to appreciate in the second half of the year.In the trade war, the United States aims to curb the development of China's technology industry, not the exchange rate issue. The recent White House report on China also did not mention the issue of the RMB exchange rate, which may indicate that the Trump administration has no obvious demand for the RMB exchange rate.The outlook for the US economy is optimistic, the dollar still has room to appreciate, and the dollar index may hover between 95 and 100 in the second half of the year.Accordingly, the RMB may fall slightly against the dollar in two-way fluctuations, but it is expected to remain stable against a basket of currencies.

2. Historical vertical comparison: compared with 15 years, the impact of 18-year RMB depreciation on A shares is relatively limited.

Fundamentals: 15 years of late deflation, 18 years of moderate economic decline.After 15 years of exchange rate reform, China's sovereign CDS prices soared, reflecting a marked rise in investors' concerns about China's economic fundamentals, while China's sovereign CDS prices have fallen since the devaluation of the RMB exchange rate in late April 18, indicating that investors are not worried about China's economic fundamentals because of the devaluation of the renminbi.

Liquidity: 15 years of northward capital outflow, 18 years of continuous inflows more stable in the near future.However, since the devaluation of the RMB in April 18, there has been a net inflow of capital northward for two months in a row, and the scale of the net inflow has significantly expanded.

Risk preference-valuation: 15 years of higher valuation ERP rise, the current valuation is lower, ERP has limited room to rise.Since the devaluation of the RMB in mid-April 18, the equity risk premium of A shares has fluctuated upward, and the ERP in May has even fallen.

3. How to affect the industry

Electronics, home appliances benefit.Electronics, home appliances, textiles and clothing and other industries account for a relatively high proportion of overseas revenue, the devaluation of the RMB will effectively stimulate exports, making these industries gain a strong competitive advantage.

The real estate, steel, extractive and transportation industries are more likely to obtain negative excess returns.Among them, at the end of 2017, the weighted proportion of US dollar liabilities (including financial leases) to total liabilities of Chinese listed airlines was as high as 29.7%, and the exchange rate depreciation had a direct impact on their profitability. After the domestic bond issuance market tightened in the second half of 2016, real estate and local financing vehicles were the main targets of financing restrictions, and overseas bond issuance increased. In the case of real estate companies, the balance of dollar debt at the end of June 2018 was as much as 50% higher than at the end of 2015 (figure 6). While China's real estate enterprises are mainly domestic business, exchange rate depreciation or increase the debt burden of real estate enterprises.