In the past year,$American Steel (X.US) $The share price soared, approaching 60% at one point. The rise in steel prices has greatly boosted the profits of American Steel, which reported adjusted earnings of $57 million, or 32 cents per share, in the first quarter, compared with an adjusted loss of $145 million, or 83 cents per share, in the same period last year. The improvement is very significant.

But investors have to be reminded that the improvement is mainly driven by higher steel prices, which are the result of steel tariffs imposed by the Trump administration. You know, although the imposition of steel tariffs has the short-term effect of pushing up steel prices, which in turn leads to a rise in US steel shares, in the international environment where a trade war is brewing, higher steel prices may affect steel demand, which is obviously disadvantageous to US steel shares.

Analysis based on bull market

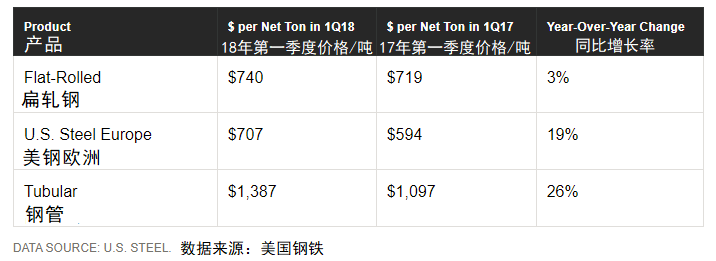

Steel prices have risen sharply over the past year as a result of the threat of tariffs, allowing US steel companies to sell steel at higher prices. The selling prices of the three main products of American Iron and Steel are shown in the table below.

Steel prices have risen sharply over the past year as a result of the threat of tariffs, allowing US steel companies to sell steel at higher prices. The selling prices of the three main products of American Iron and Steel are shown in the table below.

Us steel shipments have increased as a result of the strengthening global economy. Shipments increased by 5% in the first quarter of this year compared with the same period last year. Not only that, American steel companies have been trying to reduce costs and improve operations through the Carnegie Road Program (Carnegie Way plan), including using its growing profitability to repay debt and reduce interest payments.

Us Steel believes that this tailwind effect will be further strengthened this year. Based on this, US Steel expects adjusted EBITDA to rise to $400m in the second quarter from $255 million in the first quarter, compared with an average of about $550 million per quarter in the second half of the year. But in terms of returns, American Steel's stock is worth only 3.50 times that of EBITDA, only its competitors$Nucor Steel (NUE.US) $At the level of half the value of shares on the New York Stock Exchange. Thus, if steel prices and demand continue to rise, then American Steel's share price has room to rise further.

Analysis based on bear market

The Trump administration's tariff policy led to a rise in steel prices, which in turn sparked a global trade war, and China and Europe have hit back at the United States by imposing tariffs on other goods. President Trump recently proposed a 25% tariff on imported cars and auto parts.

Analysts believe that it is unclear how the trade war will eventually end, but there are two general ways to deal with it:

One is that countries have agreed to suspend tariffs and address the root causes of steel tariffs, which have hurt the profitability of US steel companies by dumping steel into the US at below-market prices.

Second, the United States announced its surrender and lowered tariffs on steel and other products to avoid damage to the economy. The latter could cause steel prices to plummet, and shares of American steel companies would certainly fall as well.

In addition to the above two solutions, there is another possibility that as countries impose new tariffs on more goods, the trade war will not stop, but will continue to escalate, which will seriously disrupt global trade and product demand. and further affect the stock prices of related industries (in the case of steel, for example, based on the analysis at the beginning of the article, higher steel prices will affect steel demand, which is not conducive to the rise of US steel stock prices).

It's not worth the risk for American steel.

If the rise in steel prices is due to increased demand for steel, then American Steel's stock is well worth buying because it is convincing in valuation.However, the rise in steel prices is now mainly driven by steel tariffs, which will gradually erode the market demand for steel, which is harmful to the share price of US steel in the long run.And it turns out that steel stocks will cash better when steel prices are low, and when steel pricing and demand are hit, steel stocks are likely to plummet. Therefore, the analyst in this article does not advise investors to take risks for American steel.

(this article is produced by Futu Information compilation team, compiled / Su Mengxue, proofread / Yang Weiyi)

受关税威胁的影响,钢铁价格在过去一年里大幅上涨,美国钢铁公司也因此能以更高的价格销售钢材。美国钢铁公司三类主要产品的销售价格详见下表。

受关税威胁的影响,钢铁价格在过去一年里大幅上涨,美国钢铁公司也因此能以更高的价格销售钢材。美国钢铁公司三类主要产品的销售价格详见下表。