Edited by China Merchants: keep the cloud and see the moon, the investment strategy of the insurance industry in the middle of 2018

Short-term interest is empty + continuous incremental funds + historically low valuations, and the insurance sector may be the best choice after the collapse.

1. The market of insurance stocks outperformed the market in the first half of the year due to the pressure on fundamentals.

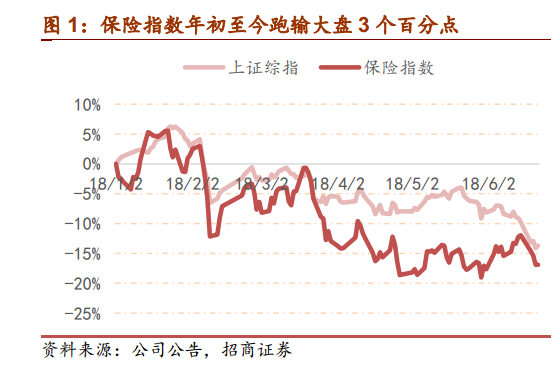

Insurance stocks performed poorly in the first half of 2018, with the insurance index down 17% year-to-date, outperforming the shanghai composite index by 3 percentage points.The reason why the insurance index outperformed the market in the first half of the year was due to the pressure on the debt side.

2. Debt side: enter the improvement channel in the short term and resume growth in the long term.

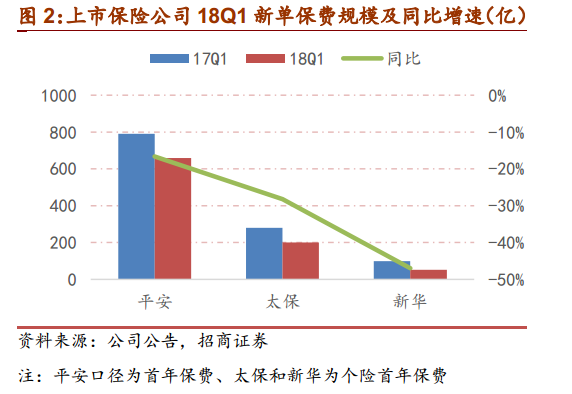

New single enterprises have picked up steadily in the short term, and the worst time has passed.As of May, the cumulative growth rates of the original premiums of Ping an, Pacific Insurance, Guoshou and Xinhua were 20%, 18%, 3% and 9%, respectively. The improvement in the short-term debt side is mainly due to the decline in the base and the overall efforts of insurance companies. Looking forward to the second half of the year, the pressure release superposition strategy continues, and the rate of decline is expected to continue to decline.

![2018060044727842607065066.png]()

![20180600447327581b3823b70.png]()

The new rules of long-term asset management break the new exchange, and the advantages of insurance capital preservation products are highlighted.The new regulations on asset management are directed at the exchange, the core advantages of bank financial management have been damaged, insurance products have capital preservation nature to benefit from the crowding-out effect, the competition pattern has improved for the first time, and we expect the debt side to start a relatively rapid growth trend in 2018.

3. Asset side: interest rate trend and high credit risk do not change the performance high growth trend.

Treasury yields have fallen at high levels, with 10-year yields falling from a high of 3.9 per cent to 34 BP so far this year, but still at 3.5 per cent high. In 2018, the pace of credit debt default accelerated, and credit events were frequently exposed, but this year's credit default events showed the transformation of private enterprises and industrial debts. although the proportion of solid income in the allocation of dangerous assets is relatively high, the strategy of allocation of dangerous assets is relatively conservative, almost avoiding the current minefield of default, and the credit debt grade is higher.

The prospect of the future: the tax extension of pension will eventually land hundreds of billions of increments on the road.Health insurance is in the ascendant.

Tax extension of pension finally landed, and hundreds of billions of increments are on the way.. The pilot tax extension pension policy is expected to increase the original premium of the life insurance industry by 7.5% in the medium term, promote the return of the industry to security for a long time, and promote the development of commercial old-age insurance.

Health insurance is in the ascendant, and digging up demand is a top priority.China's health insurance is still in its infancy, while the demand side is due to the low level of basic medical coverage and the growing demand for medical security due to the aging of the population.

4. Valuation end: absolute bottom of history, implied extremely pessimistic expectation

Since the second quarter, the fundamentals of the insurance sector have gradually improved, and at the same time, they have benefited from a long-term policy and are firmly optimistic about the investment value of the plate. Plate valuation is currently at the bottom of history. The current PEV of Ping an, Pacific Insurance, Guoshou and Xinhua in 2018 is 1.13X, 0.92X, 0.76X and 0.79X respectively, which contains extremely pessimistic expectations that insurance companies will not do new business in the future.