Edited by CICC Securities:As the $12 trillion market accelerates its integration into the world

"wayward" A-shares have recently fallen into doubt, with retail-dominated investor structures often causing market sentiment to rise and fall. WithBeInclusion of MSCI indexA sharesUshered in the opportunity of internationalization. From the perspective of the next decade, the A-share marketImmature todayOr it is the time node that is full of opportunities

The incorporation of MSCI index system into A-shares has become a catalyst for A-shares to integrate into the world..In recent years, the opening of China's capital market has ushered in milestones. Since the establishment of the Shanghai-Hong Kong Stock Connect in 2014, the establishment of the Shenzhen-Hong Kong Stock Connect in 2016, the cancellation of the total two-way investment quota of the Shanghai-Shenzhen-Hong Kong Stock Connect, the first step in the inclusion of the MSCI index system into A-shares on June 1 this year, and the recent announcement by the people's Bank of China that QFII/RQFII capital outflow restrictions have been lifted. Chinese equity assets with a total market capitalization of $12 trillion ($8,000bn of A-shares and nearly $4,000bn of overseas Chinese shares) are accelerating their integration into the global market.

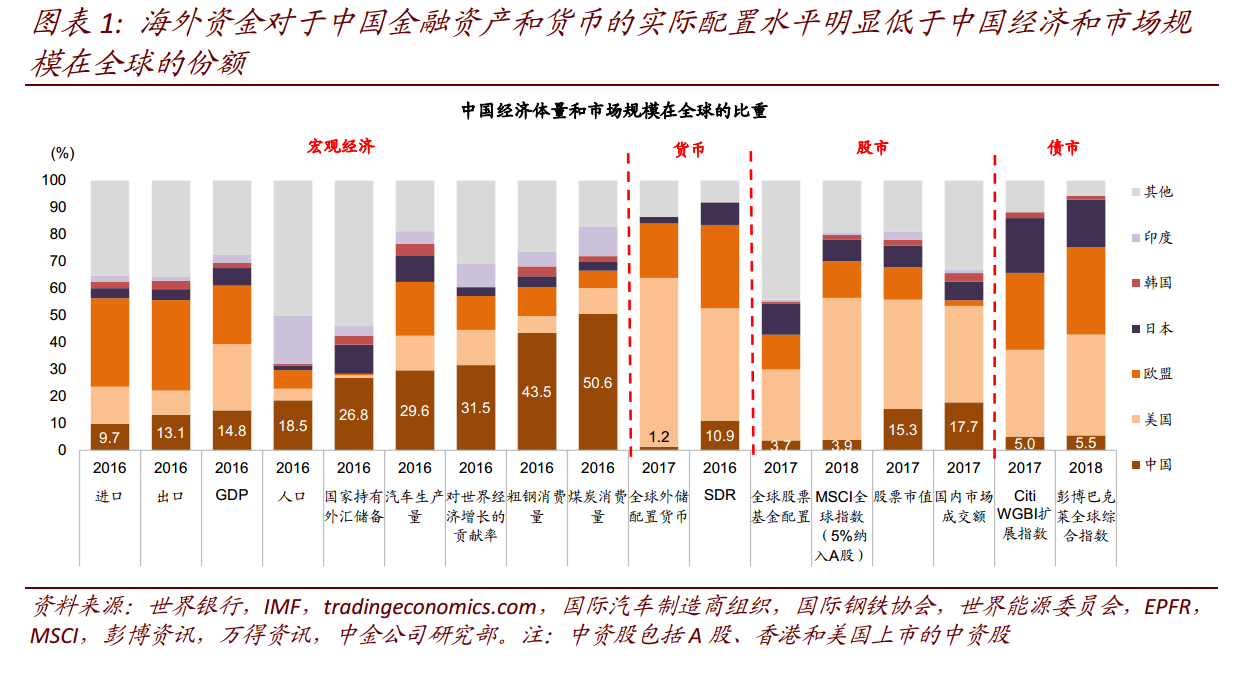

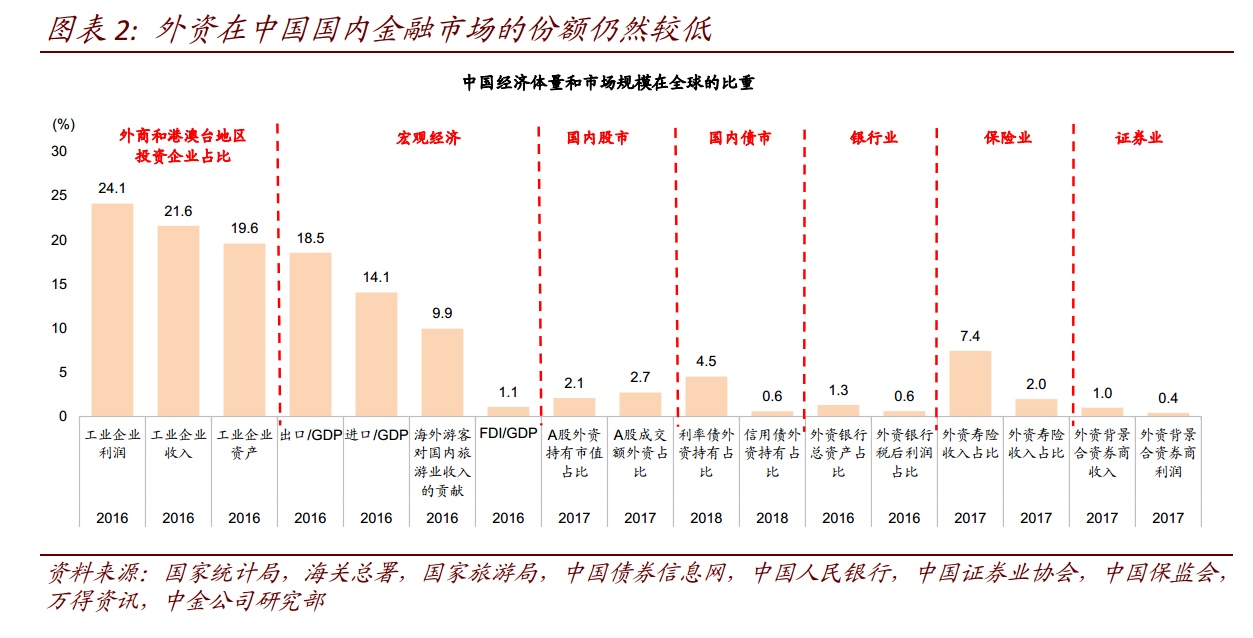

The allocation of global funds to Chinese equity assets does not match the size of the economy.China has become the world's second-largest economy with 15 per cent of GDP, with the global listed Chinese stock market worth about $12 trillion and accounting for 15 per cent of the world's total. According to EPFR, the allocation of Chinese shares by global overseas mutual funds accounts for only about 3.7 per cent; even after being included in A shares at 5 per cent, the weighting of Chinese stocks in the MSCI global index is only about 3.9 per cent. According to the statistics of the people's Bank of China, as of March 2018, the market value of A-shares held by foreign investors accounted for only 2.2% of the market, which is lower than the level of more than 10% in other major markets. China's financial industry is also less open than other industries, and foreign-funded institutions have a low market share in China.

We expect that the shareholding of overseas funds in A-shares may rise to 5-10% in the next decade, with a market capitalization of about $1 trillion, with an average annual net inflow of 2000-400 billion yuan (contracts of 30-60 billion U.S. dollars per year).South Korea, Taiwan and other markets have achieved 100% inclusion in about 10 years before and after the first inclusion of the MSCI index, and we believe that the A-share market may at least experience a similar period of time. Taking into account the progress of the inclusion, the potential space of the A-share market in the future and the profit situation of overseas investors in A-shares, we roughly estimate that the net inflow of overseas funds into A-shares in the future is about 2000-400 billion RMB per year.

![20180600409713bacd129b77a.png]()

The further opening and improvement of the capital market system is worth looking forward to.

At present, the proportion of A-share retail investors is relatively high, there is a relative lack of long-term investors, the number of excellent listed companies is small, and the regulatory system and methods need to be improved.We expect that with the further opening of the capital account in the future, the gradual integration of China's capital market into the world will still be the general direction.Including the further improvement of the QFII/RQFII system, the expansion of the scope of the Shanghai-Shenzhen-Hong Kong Stock Connect and the increase or even cancellation of the daily trading quota, the introduction of more product types, the integration of different open channels, the gradual opening up to overseas institutions, the gradual relaxation of overseas investment by mainland institutions and individuals, the improvement and integration of the regulatory system and framework, and the continued improvement of corporate governance. It is worth looking forward to the direction of further opening up and integration. Opening up will also promote the process of continuing reform, along with these changes, including the stock market.China's capital market will become more and more institutionalized, mature and internationalized.

Broad domestic demand makes it a hotbed for excellent growth companies, with consumption, medicine and science and technology as the focus.

Although the macro level has been controversial in recent years, more and more investors realize that the strong potential of domestic demand, the rapid growth of the economy, and the economic structure of the transformation between the new and the old have made China a hotbed of cultivating excellent growth companies. China's new economy industry has attracted worldwide attention in recent years, and China's potential is still huge in the areas of consumption and services, medicine, science and technology. From the perspective of global investors, we select nearly 6000 investable companies around the world, including A-shares, according to triple criteria. 68% of the selected companies are from China, indicating that the Chinese market provides global investors with better investment opportunities for growth companies.