U. S. stock index futures rose on Wednesday, indicating that U. S. stocks will open higher, and fears of a trade war between China and the United States seem to be receding.

[hot news]

Russian Minister of Economic Development Olichkin: Russia will impose tariffs on American goods at the same level. The move will be in response to US tariffs on steel and aluminum and will not affect Russia's macroeconomic performance.

The European Commission gave final approval for retaliatory tariffs, launching preliminary retaliatory measures against US metal tariffs, which will impose a tax on 2.8 billion euros of imports from the United States from Friday.

[summary of A shares, Hong Kong stocks and European stocks]

Asian stock markets rebounded across the board on Wednesday.

The Nikkei index climbed 1.24%, A shares bottomed out and closed higher, the Prev recovered 2900 points, and the pioneer gem rebounded by more than 1%.

Hong Kong stocks ended four consecutive trading days of declines today, rebounding more than 500 points from their lows at one point, closing up 228.02 points, or 0.77%, at 29696.17 points.

European stocks rebounded from nearly three-week lows today as bad news about US-China trade relations has been digested, with the European Stoxx 600 index rising 0.6 per cent to 385.61, hoping to recover a 0.7 per cent loss yesterday.

[important news from American companies]

$Micron Technology Inc (MU.US) $: up 1% before trading. Chip giant Micron Technology Inc announced his financial results after trading tonight. On may 22nd, Micron announced a huge repurchase of up to $10 billion and raised its earnings guidance before soaring by more than 10 per cent. But it fell nearly 8% on May 31, as Morgan Stanley lowered Micron Technology Inc's target price to $64. "the company's DRAM products are still very strong, but it seems that this strong momentum has been digested by the stock price, because the stock is very close to our previous target price of $65," Morgan Stanley said. "

Will tonight's financial report bring different results?

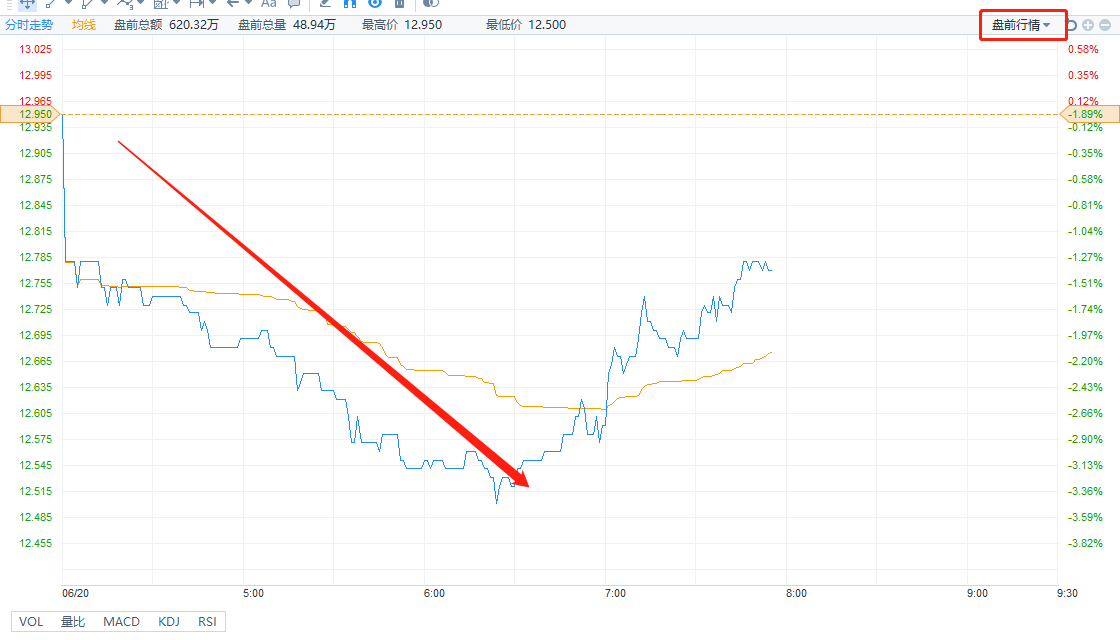

$General Electric Co (GE.US) $At one point, it fell nearly 3.5% before the trading.. The reason is that it was dropped from the Dow.

Standard & Poor's Dow Jones Indices announced Tuesday afternoon that General Electric Co has been dropped from the Dow and will be replaced by U.S. Pharmaceutical retailer Walgreens Boots Alliance Inc. (WBA).

David Blitzer, managing director of the Dow Jones Index, said in a statement that today's changes in the Dow will make it more representative of the current state of the US economy and the stock market. The change will take effect on June 26th.

Futu Information learned that the Dow Jones Industrial average Index of 30 stocks was published in 1896. General Electric Co is one of the top 30 primitive stocks in the Dow. Although it was briefly excluded, General Electric Co has been on the Dow since November 7, 1907. never absent. It used to be the most valuable company in the United States.

It can be said that General Electric Co missed every night, and his removal from the Dow is the latest setback, which has been hit by divestiture of financial businesses and competition problems in recent years. Its share price has halved since the end of 2016.

Pharmaceutical retailer Walgreens Boots Alliance Inc. (WBA), which once soared more than 4% before trading, now has a market capitalization of $64 billion.

$PayPal Holdings Inc (PYPL.US) $Is close to a deal to buy Hyperwallet for $400m.PayPal Holdings Inc is close to a deal to buy Hyperwallet Systems Inc., a financial technology company, for about $400m, according to people familiar with the matter. At present, PayPal Holdings Inc's market capitalization has exceeded 100 billion US dollars, which is even larger than Baidu, Inc. 's.

$Starbucks Corp (SBUX.US) $It fell by more than 3.6% before the session.The reason is that on the 19th, Starbucks Corp cut his sales forecast for the third quarter and said he would reduce the number of stores, while the three major investment banks cut their target prices at the same time. Starbucks Corp expects global same-store sales to grow by 1% in the third quarter, the market is expected to grow by 2.9%, and downgrade the adjusted EPS guidance for 2018 to $2.39-$2.43. In addition, the number of new licensed stores will be reduced by about 100 in 2019, and Starbucks Corp said the company will close 150 direct stores in the US market in the next fiscal year, three times the number of stores closed each year in previous years.

Wells Fargo & Co lowered Starbucks Corp's target price to $64, compared with $65 previously.

Barclays lowered its target price for Starbucks Corp to $60, compared with $65 previously.

Morgan Stanley lowered Starbucks Corp's target price to $59, up from $72.

$Oracle Corp (ORCL.US) $At one point, it fell nearly 5% before the trading.

Oracle Corp released his financial results for the fourth quarter and the whole year of fiscal year 2018 after trading yesterday. According to the report, Oracle Corp's total revenue in the fourth quarter was $11.251 billion, up 3% from $10.892 billion in the same period last year, up 2% year-on-year, excluding exchange rate changes, and net profit was $3.408 billion, up 5% from $3.231 billion in the same period last year. But its shares are still down nearly 4 per cent in after-hours trading.

Barclays lowered its target price for Oracle Corp to $58, up from $60.

[important news of Chinese stocks]

$iQIYI, Inc. (IQ.US) $、$HUYA Inc. (HUYA.US) $Pre-market riseAt one point, iQIYI, Inc. rose 4.5% and HUYA Inc. rose 6.4%. It is understood that since HUYA Inc. and iQIYI, Inc. went public, they have both increased by nearly 200%.

$BABA (BABA.US) $Aliyun is the first to jointly provide IPv6 services with the three major operators. It is understood that Aliyun announced on the 20th that it will jointly provide IPv6 services to the three major operators. Jiang Jiangwei, head of technology research and development at Aliyun, said Aliyun plans to provide IPv6 services to 10 million enterprises and 10 billion devices within five years. In terms of specific cooperation, Aliyun will carry out in-depth cooperation with the three major telecom operators and education networks to achieve a comprehensive "cloud-management-end" connection, and users' terminal devices, operator networks and cloud applications will be able to support IPv6 at the same time.

Note: IPv6 is the abbreviation of Internet Protocol Version 6, in which Internet Protocol is translated as "Internet Protocol". IPv6 is the next generation IP protocol designed by IETF (Internet Engineering Task Force, Internet Engineering Task Force) to replace the current version of IP Protocol (IPv4). It claims to be able to compile a web site for every grain of sand in the world.

The biggest problem of IPv4 lies in the limited network address resources, which seriously restricts the application and development of the Internet. The use of IPv6 can not only solve the problem of the number of network address resources, but also solve the obstacles for a variety of access devices to connect to the Internet.

(editor / Golden Forest)