This article is edited by Haitong: underestimate against the impact of events.

Today, A shares are "rivers of blood". At one point, the Shanghai Composite Index fell nearly 4 per cent to break through 2900 points, the Shenzhen Composite Index fell 5.31 per cent, and the gem also fell 5.76 per cent. By the close, more than 600 stocks in the two markets had fallen by the daily limit. During the A-share crash in 2016, thousands of shares fell by the limit, and even the index approached the limit again! Why did A shares plummet?

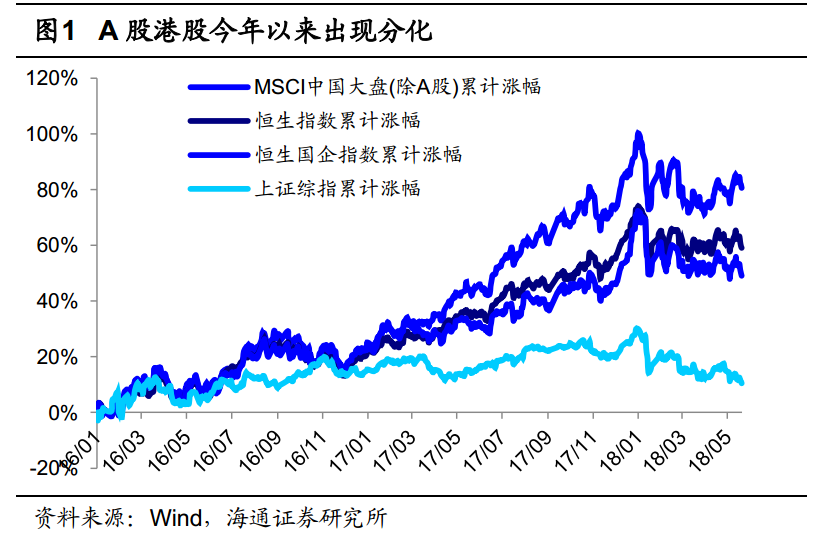

Xun Yugen, the best strategy analyst for New Fortune A shares in 2017, believes that A shares have weakened since February and have been adjusted for four and a half months, but the macro and micro fundamentals have not deteriorated significantly in the past few months.The market has been disturbed by external factors. Sino-US trade frictions and domestic deleveraging are like events on the road, constantly affecting the market.Market valuations have returned to their lowest level since 2016, undervalued to counter disruptions.

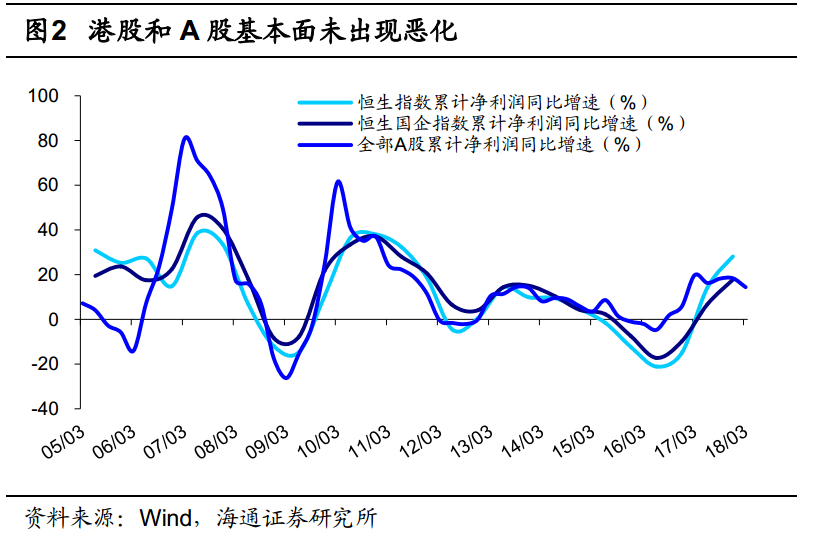

The weakness of A shares is due to interference events rather than poor fundamentals.

From a fundamental point of view, the year-on-year growth rate of net profit of all A shares in 16 / 17 / 18Q1 is 16.3% 18.4%, that of Hang Seng Index is-14.9%, and that of Hang Seng China Enterprises Index is-9.8%. The fundamental performance of both markets is not bad. The reason for the differentiation is that Hong Kong stocks continue to go bull driven by fundamentals. On the other hand, A shares are constantly affected by Sino-US trade frictions, domestic deleveraging and other factors, and the market sentiment and capital side become worse.

The market valuation level has returned to around 2638 points of the Shanghai Composite Index.

From the perspective of major market indices, the Shanghai Composite Index, Wandequan A, Shanghai 50, Shanghai and Shenzhen 300 and small and medium-sized board indexes are now close to the valuation level of the Shanghai Composite Index at 2638 points. From a sub-industry point of view, in terms of PE to measure the valuation level of consumption and technology industries, except for food and beverage, home appliances and communications when the PE is higher than 2638 points, the PE of the remaining industries is close to or lower than the 2638-point level.

The withdrawal of domestic capital and the entry of foreign capital are the most important characteristics of A shares in the past few months.

Although the recent performance of A shares is weak, Lugang Tong's northward capital inflows are accelerating, with net inflows of 387,508 and 32.5 billion yuan in April, May and June respectively (as of June 15, the same below), which is significantly higher than the average level of 16.6 billion yuan in 2017. For Hong Kong stocks with stronger performance, there was a net outflow of southward capital from Lugang Tong, with a net outflow of 49 yuan, 18 yuan and 5.4 billion yuan in April, May and June respectively, significantly less than the average net inflow of 25.7 billion yuan in 2017. While foreign capital continues to enter the A-share market, domestic investment is retreating. The position of equity funds has dropped from 88.3% at the end of March to the current 85.8%, and the position of the top 10 equity funds has also dropped from 88.6% to 85.1%.

Coping strategies

The bottom stage of the great shock pattern.As long as the background of the L-shaped macroeconomic growth since 2016 remains unchanged, the bottom estimate will be valid.If the general pattern of the concussion city is broken, that is, the bottom of the valuation will be broken down and then go down the stage, the risk point will come from overseas.Domestic deleveraging can be controlled as a whole, inflationary pressure is not enough, and there is a lot of room for manoeuvre. After the bottom of the valuation of the shock city, there is a process of repairing the sentiment of the market.

At the bottom of the big shock pattern, absolute income investors can wait, while relative income investors need to be stable.Cyclical industries with strong correlation with macro-cycle are generally in the doldrums, while consumer stocks and pharmaceutical stocks with weak correlation with macro-cycle are stronger.In addition, the allocation point of view of the high margin of valuation of the industry, PB-ROE perspective analysis, banking, real estate is better.The basic face of the technology industry is expected to usher in an inflection point, affected by Sino-US trade frictions in the short term, adhere to the performance as the king, waiting for the performance to be on the ground.

For more exciting dehydration research reports, please click:Research report essence 101

For more exciting dehydration research reports, please click:Research report essence 101