This article is edited by Anxin Securities: a study on the value-driven of Chinese Insurance companies

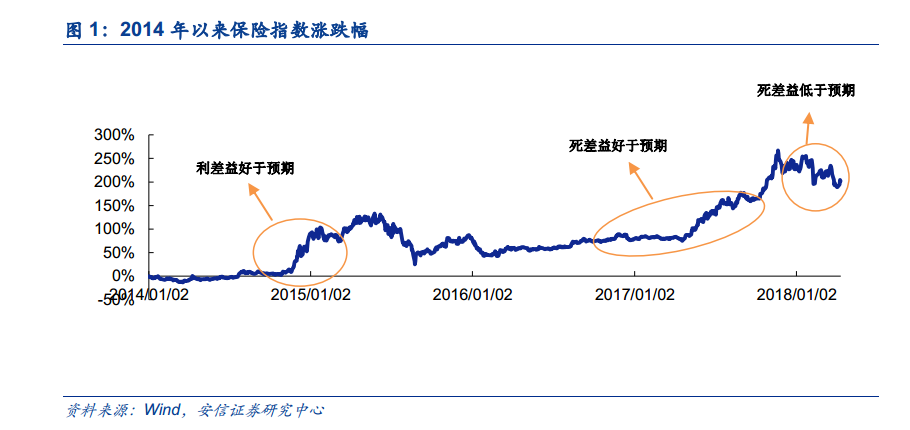

Insurance stocks rose 70% from late 2014 to mid-2015, 80% in 2017, but down 8% since the beginning of 2018. Best Hong Kong Stock Strategy analyst Zhang Yidong's latest report on June 12.Zhang Yidong's mid-year outlook for Hong Kong shares: whether it will be extremely prosperous.Once again, I reiterate that I am optimistic about the insurance sector. what determines the stock price of insurance stocks?

1. The joint action of "three differences" drives the value of insurance stocks.

The value growth of insurance companies is usually driven by three differences, namely, death difference, interest difference and fee difference, in which the main variables are death difference and interest margin.Death margin refers to the surplus generated when the actual mortality rate is less than the intended mortality rate, focusing on underwriting profit; spread refers to the surplus generated when the actual rate of return on investment is higher than the actuarial hypothetical interest rate, focusing on investment profit.

The main drivers of the value growth of insurance companies are different in different market environments, for example, the spread dominates the value growth of insurance companies from the end of 2014 to mid-2015, and the death margin has exceeded the interest margin since 2016 has become a more important driver of the value growth of insurance companies. The rise and fall of insurance stocks is essentially determined by the expected difference between death margin and interest margin.

2. Death benefit rather than interest margin has been the main cause of value growth since 2016.

In the developing insurance market, the new premiums of insurance companies are growing rapidly, and the value rate of new business is rising steadily. Underwriting profit is usually the main source of profits of insurance companies, and death profit rather than interest difference is the main reason for the value growth of insurance companies. However, due to the influence of regulatory policies, capital market fluctuations and many other factors, the death margin shows periodic characteristics. Take Ping an as an example, the proportion of death benefit and fee difference in the new business value of life insurance and health insurance exceeded the interest spread in 2017.

3. Interest rate differentials dominate value growth from 2014 to 2015

Unlike since 2016, the central bank's interest rate cut has led to a double bull in equity and debt from the end of 2014 to mid-2015, and the investment profits of insurance companies have increased sharply, and the spread has dominated the growth of the value of insurance companies. However, the elasticity of interest spread mainly comes from equity investment income rather than fixed investment income. The impact of upward interest rate on the investment return of insurance companies is a double-edged sword. While the upward interest rate improves the rate of return on new assets, the floating loss of stock bond assets increases.

4. Buffett's insurance company is more dependent on spread-driven.

Insurance companies in developed insurance markets rely more on interest spreads rather than dead gains. The main reason is that after long-term development, the growth rate of premiums continues to slow down, and insurance companies need to achieve more investment returns through more effective asset allocation. In order to ensure the growth of the company's value.

5. Death difference will still dominate the value growth of insurance companies in China for a long time.

The rise and fall of insurance stocks is essentially determined by the expected difference between death margin and interest margin. China's insurance market is still in the process of rapid development, and there is still a big gap between China and the developed insurance market. In the long run, there is still a lot of room for development, so for quite a long time, the value growth of insurance companies in China will mainly rely on the high-speed growth of insurance premiums, that is, dead profit growth rather than interest margin growth. In the short term, a sharp decline in premiums for a good start to 2018 will have an impact on the growth of the death gap.