This article is compiled from Tianfeng Securities Research News:The property insurance leader with the core profit of underwriting, the car insurance is not flying with both wings.

PICC Property and Casualty-PICC property insurance is the core asset of PICC, which has a 69 per cent stake in the former. On June 5, PICC successfully passed the Development Review Committee, and the A-share market welcomed insurance companies again after 7 years. PICC has become the first insurance group in China to focus on property insurance and issue in the form of "Aban H".

1 、PICC Property and Casualty: the leader in the oligopoly industry, 2018Q1's market share and profits have both increased by more than 70%. The revenue is contributed by auto insurance.

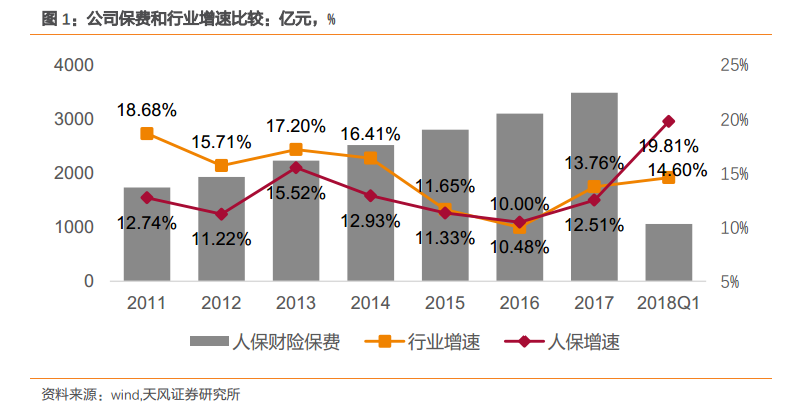

The total premium income of PICC in 2017 was 350.314 billion yuan, exceeding the total premiums of Ping an property Insurance and PICC property Insurance, which ranked 2nd and 3rd. In 2018, the growth rate of Q1 premiums greatly exceeded that of the market, and the market share increased by 118bp to 34.32%.PICC's net profit in the first quarter of this year was 5.403 billion yuan, leading Ping an property Insurance, which ranked second, at 2.333 billion yuan.

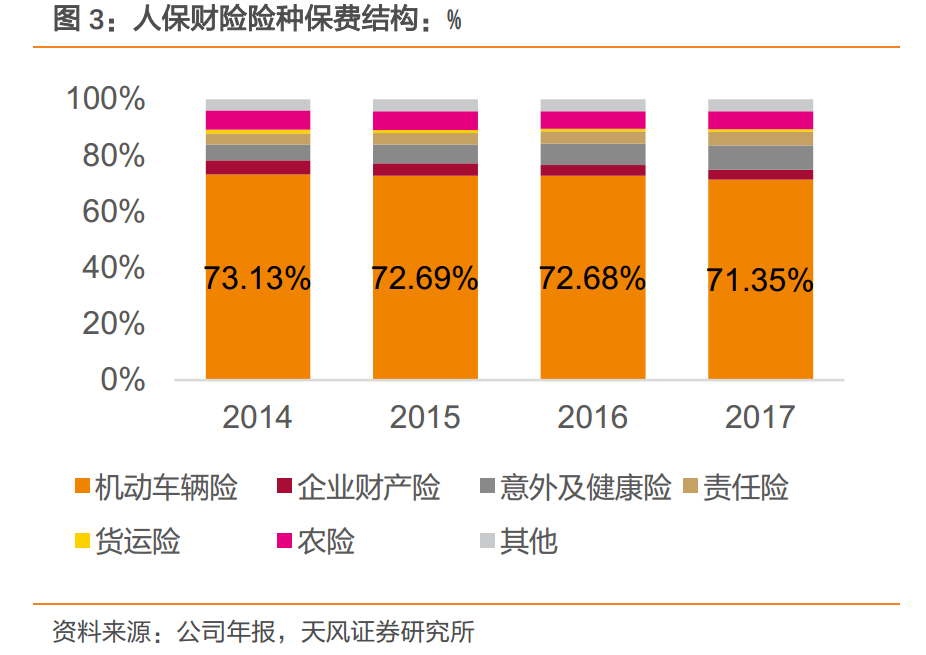

In terms of business structure, auto insurance still accounts for more than 70% of PICC's premium income, while contributing the vast majority of underwriting profits.The growth rate of accident health insurance and liability insurance has increased rapidly in the past two years.In 2017, the underwriting profit of 1.253 billion yuan of agricultural insurance is second only to auto insurance, accounting for 13.48% of the total underwriting profit, which is another core insurance of PICC.

2. the underwriting profit margin has a significant scale effect, and the low PICC rate is its core competitiveness.

The underwriting profit margin has a significant scale effect, and the explanation degree of the expense rate to the comprehensive cost rate has reached 64.5% and 53.9% in the past two years. PICC expense rate continues to be lower than Ping an property insurance, which is its core competitiveness.

3. the growth rate of non-car insurance premiums is accelerated, and it is expected to become a new profit support point after the resource investment period.

In 2017, the company's non-car insurance premium growth rate reached 17.98%, higher than the 10.46% car insurance premium growth rate. Among them, liability insurance has a compound growth rate of 18.2% in the past five years, the average underwriting net profit margin is 6.3%, and the average underwriting profit margin of agricultural insurance since 2013 is 11.2%, accounting for 19.5% of the company's underwriting profit of all types of insurance. accident injury and health insurance premiums are growing at an average annual rate of 32.5% driven by the expansion of medical coverage for serious diseases.

4. the duration of the investment assets is longer, and the return on equity investment of Huaxia Bank is higher.

At present, the duration of PICC property insurance assets is 4-5 years, and the average rate of return on net investment, total investment and comprehensive investment since 2012 can reach 4.25%, 5.04% and 5.96%, which is comparable to that of Ping an Insurance.In 2017, the company's 19.99% stake in Huaxia Bank received a return on investment of 4.575 billion yuan.