Refined from Zhejiang Securities Research report: the global market is growing steadily, and the volume and price of double reform are rising.

Summary: the steady growth of the global blood products market, the unique advantage of large demand, the dual reform of domestic policy regulation, quantity and price restrictions, the high concentration of oligarchic competitive market, and the inflection point of rising volume and price is just around the corner.

1. In medicine, blood products have unique advantages that cannot be replaced.

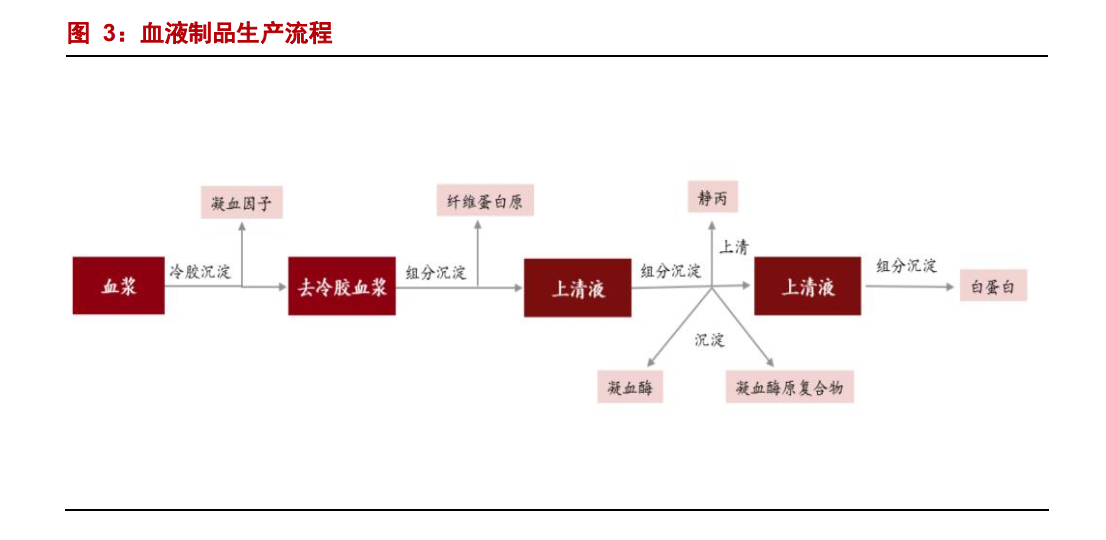

There are a wide variety of blood products and a wide range of indications. The particularity of the general pharmaceutical industry lies in the scarcity of raw materials and the vast majority of products can not be manufactured by genetic engineering. It plays a very important role in the clinical treatment and prevention of many diseases, and the blood products extracted by plasma play an irreplaceable role.

2. The global market is growing steadily, and the oligopoly market is highly concentrated.

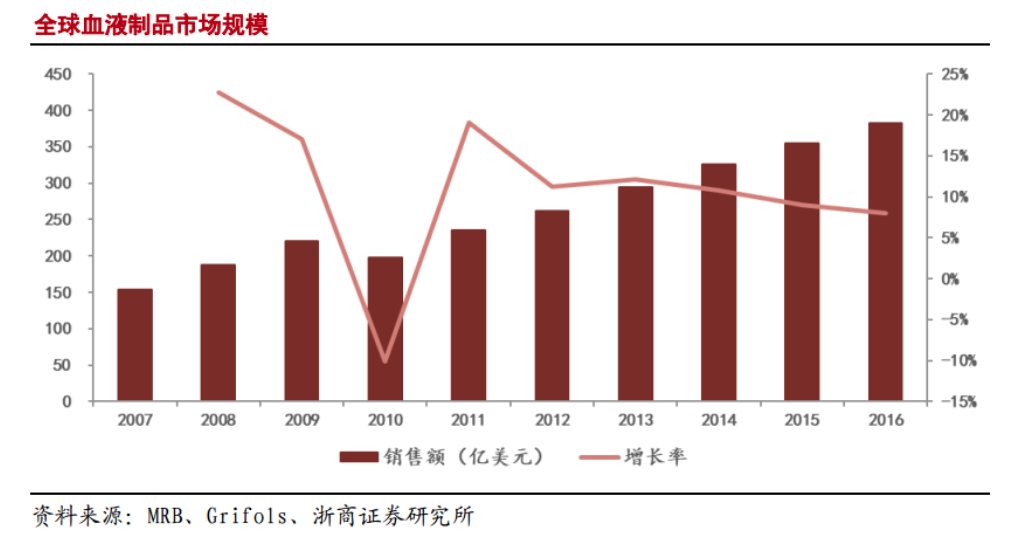

The market for globular blood products is growing steadily. According to MRB data, the global market for blood products derived from plasma reached US $33.5 billion in 2016, and is expected to maintain a steady compound growth rate of 5% and 6%, and the global market will reach nearly US $42.6 billion in 2021. The global blood products industry presents a pattern of oligopoly competition. The revenue of the three giants Shire, CSL and Grifols in 2017 is more than 4 billion US dollars, which is obviously far from the fourth Octapharma's 1.7 billion US dollars, and the market concentration is high.M & An is the most common means to expand its scale, which runs through the development of blood products industry.

3. American blood products lead the development of the global industry and are the only self-sufficient country in the world.

From the development process of the global blood products industry, the United States is the founding place of this industry. From the creation of the most important method of grading plasma, the invention of virus inactivation technology, to the setting of industry standards, the "every move" of the United States in the blood products industry has led the development of the blood products industry in the world.

The annual pulp production capacity of the United States is between 15000 and 20,000 tons, accounting for more than 70% of the global pulp production.It can not only meet the domestic demand for blood products, but also more than half of the plasma is exported abroad in the form of raw plasma or finished products.The United States is also the world's largest consumer of blood products.Its blood products market accounts for 40% of the world's sales.15% of the population in Europe and the United States consume more than 65% of blood products.

4. There is much room for improvement in domestic market scale, concentration and product consumption structure.

From the perspective of consumption structure, foreign consumption accounts for more immunoglobulin and coagulation factor products, which are relatively low in China, which are 34% and 3% respectively, and the product structure needs to be improved.From 2001, the state will no longer approve new blood products production enterprises, blood products enterprises, licenses have become scarce resources, to the present 33 enterprises.

5. The main limiting factors of this industry in China are the insufficient supply of raw material plasma and the non-market control of price.

With the cancellation of the government price limit and the significant acceleration of the approval of pulp stations, the volume and price restrictions of the industry will be gradually lifted. Since 2015, the trend of volume and price has been healthier, while the prices of some small varieties have also shown a structural upward trend. Since the release of the maximum retail price limit on June 1, 2015, the ex-factory prices of fibrinogen and JingC have increased by about 80-130% year-on-year (0.5g from 280 yuan / unit to 650 yuan / unit) and 10-20% (2.5g from 550 yuan / unit to 700 yuan / unit), respectively. Other products have also seen varying degrees of price increases, directly boost the performance of relevant enterprises.