Summary:

Leandbar is in a very sound financial position and is trying to give back to shareholders through dividends and share buybacks.

Compared with the overall market and the industry, the stock seems undervalued.

Earnings expectations for the stock are rising.

The stock showed considerable relative strength.

Taking all the factors together, investors are likely to get attractive returns from Basel in the future.

Leeder Basle(LyondellBasell) is a leading chemical company with operations in 18 countries and is a leading producer of polyethylene, polypropylene and epoxy propylene. Basel products are used in a variety of consumer and industrial end products, such as electronics, automotive industry, construction and packaging.

Sound financial position

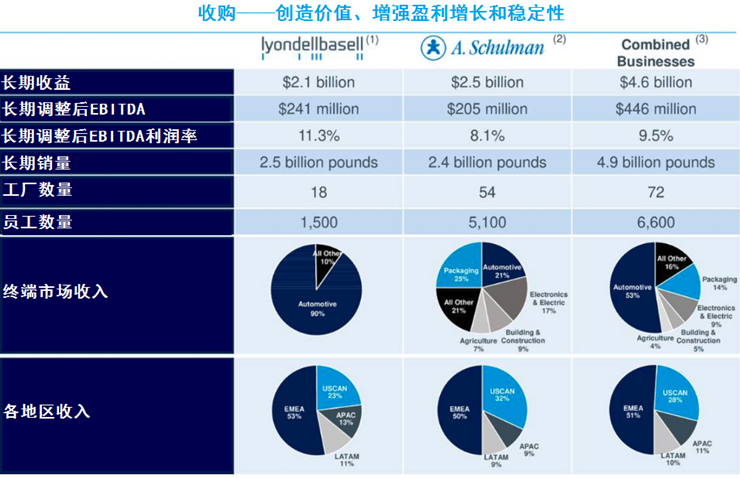

In February, Basel announced that it would buy it for $2.25 billion.Shulman plastics co., Ltd.-- the world's leading plastic supplier.The deal presents a good growth opportunity for its packaging, consumer goods and electronics sectors. Through the acquisition, management is expected to achieve $150 million in operating cost synergies within two years.

(source: LyondellBasell)

Business sales and earnings in Basel achieved strong performance in the first quarter of 2018.First-quarter revenue was $9.76 billion, up 15.8% from a year earlier; quarterly EBITDA rose 18% year-on-year to $1.9 billion, a record for the company; and net income for the quarter reached $1.2 billion, up 54% from the first quarter of 2017.

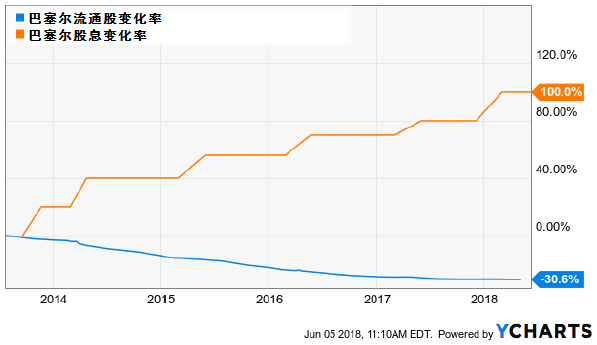

As companies generate more cash than they need to reinvest, management generously rewards investors by paying dividends and share buybacks.Just recently, Basel announced a new share buyback program that will buy back up to 10 per cent of outstanding shares over a period of 18 months. As things stand, investors in Basel seem to benefit a lot from the company's cash allocation in the coming months. The chart below shows the increase in dividends in Basel and the decrease in outstanding shares over the past five years.

(source: YCharts)

An attractive valuation

The valuation of Basel is one of the main reasons for our long-term bullish because the company's stock is very cheap in many ways.

Wall Street analysts expect Basel to earn an average of $10.85 a share in 2019. As a result, it is speculated that the stock's current forward price-to-earnings ratio is around 10.45, which is definitely "profitable" for investors compared with the average forward price-to-earnings ratio of 16.5 times for S & P 500 companies. For further illustration, the following table shows Basel and its peers:Prax.、Yikang 、Xuan Wei和PPGKey valuation indicators. Basle is the cheapest stock in terms of expected pram E, PEG, pact S, P/FCF and dividend yield.

(source: LyondellBasell,Praxair, Ecolab,Sherwin-Williams and PPG)

In short, the price of Basel is very attractive compared with the overall market and its peers. Several valuation indicators have come to the same conclusion, which makes the valuation in Basel very reliable and convincing.

Strong fundamentals

Fundamental performance compared to market expectations can have a huge impact on a stock. Usually, when a company has both better-than-expected performance and rising expected earnings, its share price is often moving in the right direction.

In terms of earnings forecasts, Wall Street analysts recently sharply raised their earnings forecasts for Basel 2019. As for the comparison between actual share prices and earnings expectations, we can see from the chart below that the movements of stock prices and earnings expectations were almost the same between the second quarter of 2017 and January 2018, but there was some disconnect between the two variables in the months that followed. That's for sure,If by the middle of this year, the share price of Basel can exceed the earnings forecast, its share price will rise. "be imperative」。

(source: YCharts)

Relative strength of force

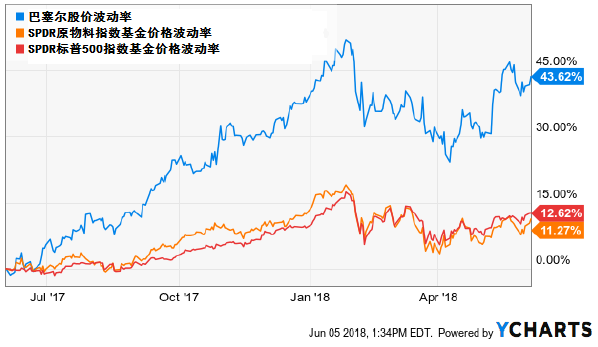

There is an opportunity cost in the use of funds, and when you buy a stock with a mediocre return, you miss out on another stock with great potential. In addition, the Matthew effect also plays a role in the stock market, and the strong are always strong, so the stocks you invest in should not only perform well, but also perform better than other stocks. As we can see from the picture below, Basel has outperformed itself in the past year.APDR S & P 500 Index Fund和SPDR Raw material Index Base Fund。

(source: YCharts)

Retrospective analysis

PowerFactors is a quantitative investment system that ranks company stocks in a particular field according to the analytical factors mentioned in this article, including quality, valuation, momentum and relative strength. This system has produced reliable retrospective analysis performance for a long time. The following chart shows that since 1999S & P 500 indexThe performance of the top 50 stocks compared with the SPDR S & P 500 index ETF.

(source: slap Global via Portfolio123)

Retrospective analysis showed that their returns were more than double that of the benchmark, with 50 S & P 500 stocks returning 12.92% a year, compared with 6.13% for ETF over the same period. In other words, the $100000 investment in SPDR's S & P 500ETF in January 1999 is now worth about $317000, while the same amount invested in a quantitative portfolio is now worth much more, $1.05 million.Basel is one of the 50 stocks selected, meaning it is one of the top 10% of the s & p 500 when combined with four quantitative indicators of financial quality, valuation, momentum and relative strength. Especially under the quantitative indicators of valuation and relative strength, the stock is very attractive.

Past performance does not guarantee future returns, and retrospective analysis of data is sometimes unreliable. But at least it shows thatThe stock price of Basel is really cheap, and its share price is much better than the industry and the market. In view of this, Basel can be said to be really good.

The writer is Andres Cardenal, an analyst at Seeking Alpha, a US stock investment website.

(this article is produced by Futu Information compilation team, compiled / Chen Shifeng, proofread / Yang Weiyi)