Edited by Soochow Securities: turnover acceleration, sales improvement, the rise of commercial operations at the right time

Baolong Real Estate:The subsidiary of Baolong Group focuses on the development and operation of comprehensive commercial real estate projects. at present, the company's main business covers property development, property investment and management, hotels and other three major categories. He has won honors such as "Top 100 Chinese Real Estate Enterprises", "2017 Chinese Commercial Real Estate Outstanding Enterprises", "2017 Chinese Real Estate listed companies excellent Business Operation Enterprises" and so on.

Main business and performance:

The company's main business covers property development, property investment and management, hotel and other three major categories.

Property development business:

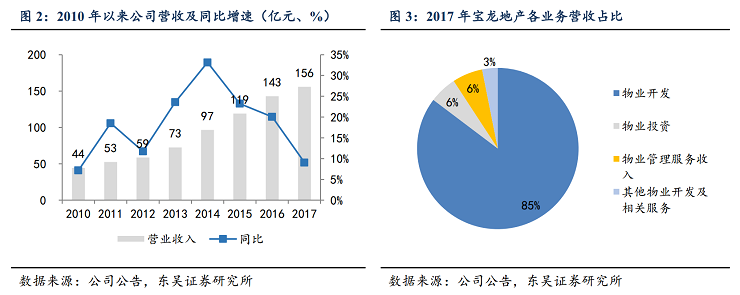

By the end of 2017, the company owned and operated 84 property development projects at different stages of development. In 2017, the company achieved operating income of 15.593 billion yuan, an increase of 9.07% over the same period last year.

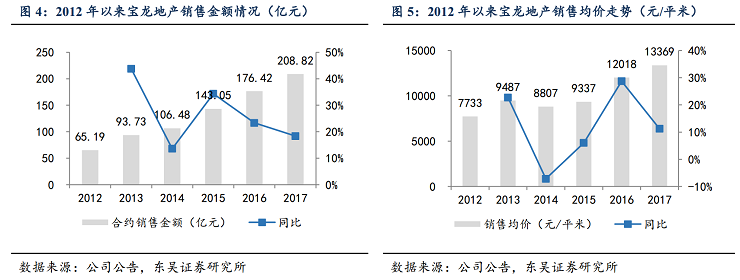

In 2017, the company realized sales of 20.88 billion yuan, an increase of 18.4% over the same period last year. By region, the company's Yangtze River Delta, Bohai Rim, Hercynian and Midwest accounted for 72%, 10%, 12% and 6% respectively. According to the product structure, the company's commerce and housing accounted for 36% and 64%, respectively.

Property Investment and Management (Commercial Real Estate) Business:

In 2017, the company operated 34 self-owned shopping malls, with a leasable area of 2.693 million square meters (excluding entrusted area), an increase of 6.3% over the same period last year. In 2017, the company realized 1.8 billion yuan in rental and property management services, an increase of 29.7 percent over the same period last year, and a compound growth rate of 26.7 percent from 2013 to 2017.

Hotel business:

By the end of 2017, the company has 9 international brand hotels and 8 self-brand chain hotels. At present, the total number of rooms in the company's 17 hotels is 3739, mainly in the Yangtze River Delta and the Bohai Rim region. In 2017, the company realized hotel revenue of about 487 million yuan, an increase of 29.9% over the same period last year. The company will continue to actively expand the size of the hotel in the next three years, and the compound growth rate of the company's expected hotel revenue from 2016 to 2020 is expected to exceed 40%.

Competitive advantage: sufficient land reserve and high quality, active acquisition of land, significant cost advantage

In 2017, the construction area of the company's land reserve (excluding operating investment properties) reached 14.091 million square meters, an increase of 31.7% over the same period last year. The company's land reserve is of high quality, and more than 70% of the land reserve is located in the first-and second-tier core cities.

The company has taken more initiative in recent years. In 2017, the company acquired 18 pieces of land with a total construction area of 3.86 million square meters, accounting for 247% of Prida's land area and sales area, with a total new value of about 70 billion yuan. In 2017, the company's new construction area in the Yangtze River Delta accounted for 82%, and the investment accounted for 84%.

The company has obvious advantages in the cost side of acquiring land. at the end of 2017, the average cost of all land reserves is 2131 yuan per square meter, accounting for only 15.9% of the average sales price in the same period. the high-quality soil storage structure matches the lower cost price, which ensures the company's better gross profit level. The 18 new projects acquired in 2017 are all carried out through cooperative land acquisition, so the premium rate of the project can be effectively controlled. The premium rate of 9 projects of the company is less than 1%, effectively controlling the cost of land acquisition.

Risk Tips:Industry sales fell sharply; mortgage interest rates rose sharply; real estate policy tightened sharply; capital costs of real estate enterprises rose sharply; Hong Kong stocks were volatile.

(editor / Jiang Wenwen)