Edited by CIC Securities: high growth is roughly locked in, park value-added services provide additional help

Greentown service:The company is a large-scale comprehensive service enterprise with property service as the foundation, service platform as the medium and intelligent technology as the means. it is one of the property service enterprises with the most property types, the widest service area and the largest service area in the same industry in the country. At present, the brand value of Greentown service has reached 4.98 billion yuan, and it has won the first prize of "Top 100 satisfaction companies of property Services in China" for many years.

The picture comes from the company's official website, http://www.lvchengfuwu.com/.

Main business and performance:

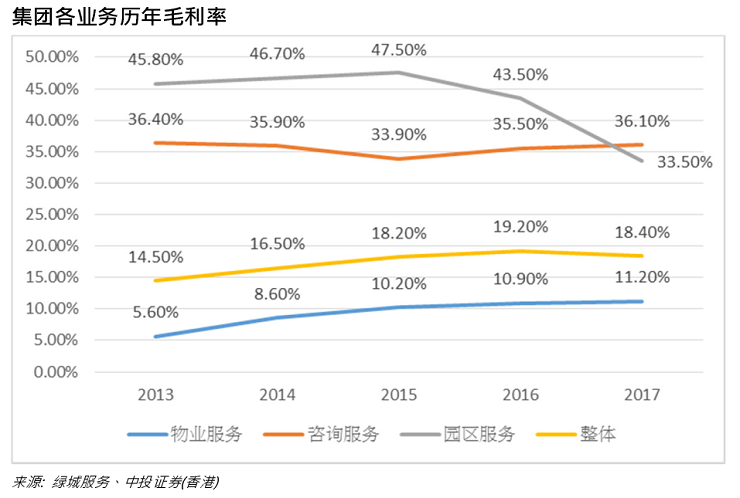

Property services, consulting services and park services are the three main businesses of Greentown services, of which property services account for the largest proportion of income, providing about 70% of the group's income for five consecutive years. In 2017, the overall gross profit margin of the group was 18.4%, which was lower than that of last year. The gross profit margin of property services was 11.2%; that of consulting services was 36.1%; and that of park services was 33.5%.

Competitive advantage:

The reserve area continues to reach a new high, locking in the rapid growth in the future.

In 2017, the managed area of Greentown service was about 138 million square meters, an increase of 33%, while the reserve area was about 150 million square meters, an increase of 31%. In the past three years, the group successfully achieved that the reserve area is higher than the managed area, indicating that there is still room for large-scale growth in income. On the other hand, the group's monthly property management fees are also rising steadily, from 2.69 yuan per square meter in 2013 to 3.11 yuan per square meter in 2017, with a compound annual growth rate of about 3.7%. In addition, most of the property management service contracts are long-term contracts, and the service income is also cash income, so the visibility of the group's future income growth is quite high, and it will also have a very high stability.

The park has great service potential and provides driving force for medium-and long-term growth.

The Group's park services provide a wide range of services for residents, including home services, park products, property asset management and education services. Revenue grew by 86% to 900 million yuan in 2017, with a compound annual growth rate of 66.5% over the past five years, double the 32.4% increase in total income over the same period. Revenue from products and services of the park business increased by 64% last year, revenue from property asset management services increased by 112%, and new business education services increased by 82%. At the same time, the Group plans to increase to 50 this year and 100 next year. Based on the 1035 property management projects currently held by the Group, there is still great potential for the growth of the education business.

Risk factors:The bid-winning rate of the project decreased, the contract renewal rate decreased, and the profit margin of education services increased less than expected.

(editor / Jiang Wenwen)