Edited by Societe Generale Securities Research News: there is nothing New under the Sun-- from the political turmoil in Italy

Due to political unrest, Italy has recently suffered a double murder between stock and debt.Why on earth is the market so nervous, and what is the impact?

Double kill of Italian stock and debt

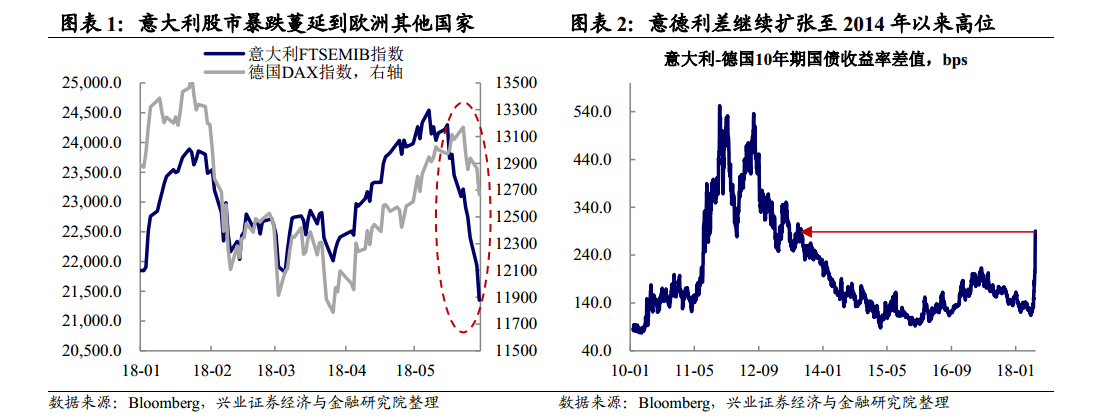

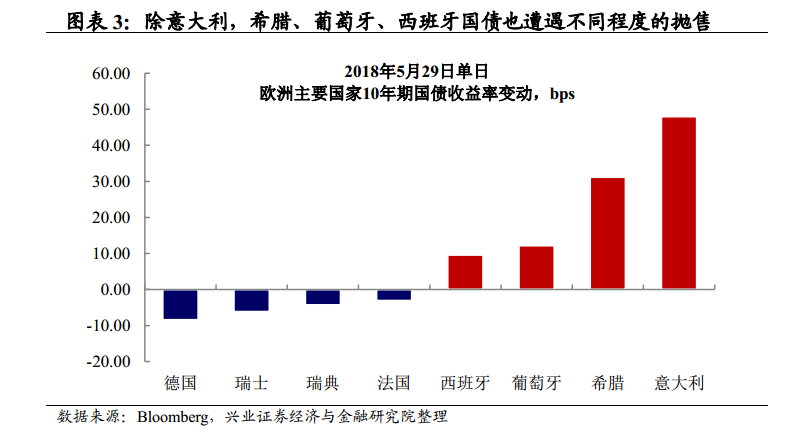

On May 29, 2018, Italy suffered a double whammy of equity and debt: Italy's FTSEMIB index fell 581.81 points, Italian 10-year bonds climbed 48 basis points to 3.164%, and Italian-German spreads continued to widen to 290bp. Volatility in Italy has also spread: German and European stock markets have fallen, while Greek, Portuguese and Spanish government bonds have also been sold off to varying degrees.

What does the market worry about: Brexit risk +Government debt +Banking problems

Worry 1: the rise of Italian populism and the increased risk of Brexit.There has been a resurgence in Italian politics as the potential for far-right parties to win re-election has fuelled fears of an Italian exit from the euro.Italy may have a domino effect in Europe and have a greater impact on financial markets.

Worry 2:The high level of government debt and the questioning of solvency affect the national debt rating.The ruling coalition's policy of fiscal expansion will add to Italy's already high debt pressure and heighten market fears of a default on the country's debt. Italy's government debt accounts for more than 130% of GDP, second only to Greece among European countries.

Worry 3: systemic risk of Italian banks.About 30% of Italian government bonds are held by Italian banks, accounting for more than 10% of Italian bank assets and more than 100% of the first-tier capital of Italian banks. Concerns about sovereign debt have also expanded to concerns about banks as a whole.

What is the impact of the Italian turmoil: fundamentals + monetary policy + exchange rate

Rising political uncertainty will be a drag on the investment that has underpinned the Italian economy over the past two years, while higher interest rates will also push up its financing costs and increase downside risks to the European economy and global fundamentals.

At the same time, high political risks may make the ECB more cautious in pushing ahead with its austerity path. Against this backdrop, there is downward pressure on the euro, which in turn could help the dollar continue to strengthen.This will pose a risk of exchange rate depreciation and capital outflows to emerging markets.

Summary