Summary:

Walmart Inc announced that he would buy a 77 per cent stake in Flipkart, an Indian online retailer, for $16 billion.

The scale of Flipkart's losses and its reliance on borrowing suggest that it is difficult for it to provide high value to the company as a separate business.

In the short term, the acquisition will accelerate competition in India's retail market.

Walmart Inc officially confirmed weeks of rumors on May 9, 2018, announcing that it would buy 77% of Flipkart, an Indian online retailer, for $16 billion. The company, which was founded with a capital of only $10, 000, is now valued at more than $21 billion. The content, motivation and aftermath of the deal have become the focus of debate among investors, whose attitude has been reflected in Walmart Inc's decline in market capitalization of about $8 billion. For Indian tech start-ups, the deal is like Nirvana that most people aspire to achieve, adding weight to their hope that if they set up business in India, big-name players will buy them.

M & A participants

M & A participants

When evaluating M & A cases, we should first pay attention to the participants in M & An activities, especially the acquirers and target companies. It can not only provide a benchmark for all kinds of benefit evaluation, but also provide clues for M & A motivation analysis.

1. 把Amazon.Com Inc asBeyond the object?

In the two players of this transaction, we obviously know more about Walmart Inc. After all, Flipkart does not trade publicly and only provides a summary of the company's information, so the understanding of Flipkart is much lower. We can use this information to draw some conclusions about the company:

Rapid growthIn October 2007, two former Amazon.Com Inc employees (Sachin and Binny Bansal) founded Flipkart with initial capital of about US $6000. The company's revenue increased from less than $1 million in 2008-09 to $75 million in 2011-12, and reached $3 billion in 2016-17 as the number of acquisitions increased. Flipkart's revenue growth in 2016-17 was 29 per cent, down from 50 per cent in the previous fiscal year.

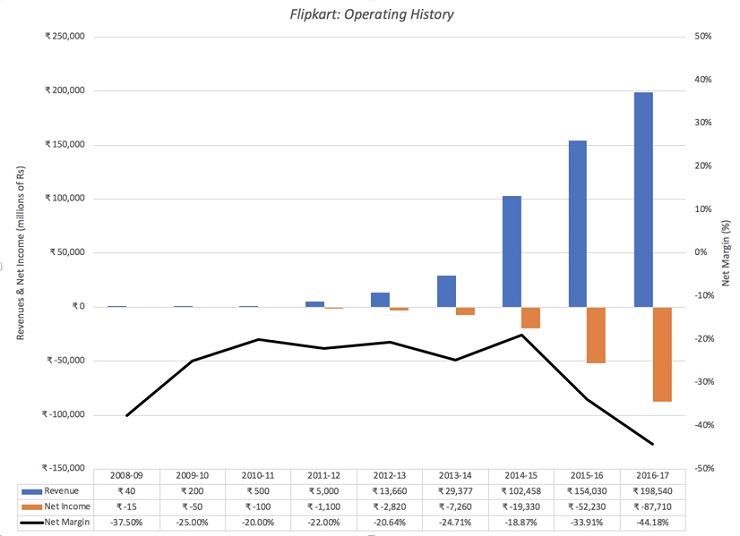

Historical operation of Flipkart Photo Source: Seeking Alpha

"burn money" modeFor early Flipkart, growth was a priority, even at the expense of losses. Unfortunately, the trend of losses not only continues, but also expands as income increases. In the 2016-17 fiscal year, for example, the company reported an operating loss of $600m and an operating margin of minus 40 per cent. As a result of the company's continued losses in the "cash burn" mode, most of the money raised from investors ($7 billion) has been consumed.

Debt financingPerhaps the founder of Flipkart is reluctant to dilute his stake, and the company uses leveraged financing rather than equity financing. In fiscal year 2016-17, its financing costs jumped to $671 million, pushing the overall loss to $1.3 billion. After all, financial expenses will not only increase losses ("burning money"), but also expose the company to the risk of isolation (excessive financial leverage will greatly reduce the company's refinancing capacity).

Corporate governance:The ownership structure of Flipkart is complicated. In addition to its parent company in Singapore, it has set up a number of branches. Some of these branches are to circumvent India's complex restrictions on foreign investment and retail, while others are to raise more venture capital.

Some people may use youth to defend Flipkart, but as an independent company, the scale of losses and reliance on borrowing is difficult to prove the high value of the company, investors will worry more about the viability of the company.

2. Walmart Inc, an old giant?

Walmart Inc has been listed for decades, so its operation will be disclosed in more detail. In the 1980s and 1990s, Walmart Inc transformed from a big store in Arkansas into a dominant American retailer.

Walmart Inc's historical operation photo source: Seeking Alpha

From the beginning of its founding to the end of the 20th century, Walmart Inc demonstrated outstanding growth that lasted for two decades. Since then, Walmart Inc, under the pressure of profit margins, readjusted his US retail business as economic growth slowed. The analysis of Walmart Inc's current operation is as follows:

Growth rate slows downSince more than a decade ago, Walmart Inc's growth has been like a trickle and has not been very prosperous. On the one hand, it has a large revenue base ($500 billion in 2017), and on the other hand, its main market, the United States, is basically saturated.

Continuous acquisitionWalmart Inc has been trying to buy other companies as sales growth in his stores slows, with Flipkart being the most recent (and most expensive) example.

Don't change your mind.With the passage of time, although Walmart Inc's profit margin gradually decreased, he still maintained his original mode of operation-- warehouse supermarket, small profit and quick turnover. The acquisition of online retailers such as Wayfair and upscale brands such as Bonobos only partly represents a shift in mission.

InfluenceIn the past few years, Walmart Inc's share of income in non-US markets (more than 20 per cent) has not increased. More than 20 per cent of Walmart Inc's income comes from markets outside the United States. and a large proportion of foreign sales come from Mexico and Canada.

According to the analysis, the only conclusion may be that Walmart Inc is not only a mature company, but also may be on the brink of decline.

Photo Source: Seeking Alpha

Few companies will be able to get through the recession in an elegant way. When this stage comes, many companies are trying to reinvent themselves by entering new markets or businesses, trying to make a final struggle with the downward curve. But few companies succeed in finding new opportunities for survival. If you are a shareholder of Walmart Inc, your return over the next decade will depend largely on what the company does during the recession.To some extent, the acquisitionFlipkartIt is one of the strongest signals of Walmart Inc's choice of "struggle". This may be a good start, but it is very expensive for shareholders.

A common enemy

A common enemy

Obviously, Flipkart and Walmart Inc are companies at both ends of the life cycle. Flipkart is a young company that is still trying to build its basic business model, which has proved successful in terms of revenue growth (non-profit growth). Walmart Inc is an old giant, although profitable, but slow growth, lack of profit space. If there is something these two companies have in common, it is that they have a common competitor: Amazon.Com Inc, the most feared company in the world.

1. Amazon.Com Inc VS FlipkartIn the past few years, Amazon.Com Inc has been actively pursuing the growth of the Indian market. Flipkart is its main competitor, although it does not fully recognize its status, but Walmart Inc said that revenue (and market share) should be given priority to profits.

Photo Source: Forrester (data from Bloomberg Quint)

Although Flipkart still occupies a large market share, Amazon.Com Inc India's continued growth is getting closer and closer, and its market share will be similar to that of Flipkart by April 2018. More importantly, Amazon.Com Inc India itself is willing to compete with Flipkart through "self-loss of three thousand". Amazon.Com Inc is like a company in the dream field, patience has been integrated into its DNA. If Flipkart and Amazon.Com Inc go head-to-head with each other in India, the final outcome of the game is not difficult to predict: Flipkart will gradually shrink in the process of running out of money and capital.

two。 Amazon.Com Inc VSWalmart IncIf there is a company in the world that understands Amazon.Com Inc's mode of operation, it must be Walmart Inc. Amazon.Com Inc has had an impact on physical retailing in the United States over the past two decades, although the initial victims may have been department stores and professional retailers. But it is shifting its targets, especially after the acquisition of Whole Foods, which has shifted to Walmart Inc and Target Corp department stores.

AlthoughFlipkartThe problems with Walmart Inc can be traced back to management decisions, expansion methods and customer needs, but fear of Amazon.Com Inc allows them to make decisions while staying awake at all times.

FlipkartPricing of

FlipkartPricing of

Walmart Inc is just the latest in a series of high-end investors that Flipkart has attracted over the years. Tiger Global has made multiple investments in the company since 2013, and other international investors have also participated in subsequent rounds of investments.

Photo Source: Seeking Alpha

Except for the period from July 2015 to the second half of 2016, the pricing of Flipkart investors increased with each capital raising. In April 2017, the company was in$Microsoft Corp (MSFT.US) $、$Tencent (00700.HK) $和$eBay, Inc. (EBAYL.US) $And other investment companies raised $1.4 billion, priced as high as $11 billion. August 2017$Softbank Corp. (ADR) (SFTBY.US) $Invest $2.5 billion in the company, priced at close to $12.5 billion. Of course, judging from Walmart Inc's investment, the company's pricing has increased significantly.

M & A motivation

M & A motivation

Why is Walmart Inc willing to pay $16 billion for a 70 per cent stake in Flipkart? Here are four possible explanations for its M & A motivation, although each explanation is accompanied by bad results.

1.Pricing gameNo matter what people think of Flipkart's business model and valuation, at least after Walmart Inc's offer, the game has really paid off for previous contestants. Walmart Inc's payment allows every investor who enters the Flipkart "pricing chain" to maintain the pricing game before it is "successful", at least for them.If the essence of the game is to buy it at a low price and then sell it at a higher price, then its benefits are obvious.Take Softbank Corp. 's investment nine months ago as an example, Flipkart's pricing has now doubled, which has greatly promoted the deal with Walmart Inc. In fact, many investors who entered the market early (including private equity and venture capital, etc.) are selling their shares to Walmart Inc and leaving quickly after making huge capital gains. Might as well guess, whether it is possible for Walmart Inc to continue to play the pricing game, or whether he plans to sell Flipkart to other passers-by at a higher price?

Walmart Inc's acquisition of shares in the company has an overwhelming advantage, and has its own operational motivation, so it is difficult to judge how Walmart Inc will play the pricing game and whether he can win. Some people believe that investors will force Walmart Inc to make Flipkart a public company within a few years, and that if Walmart Inc can promote the success of Flipkart, then his own recession path may take a turn for the better, or maybe this is just wishful thinking.

2.Tickets to the big market (real options)For decades, the results have been frustrating for all companies that want to enter the big retail market in India. From this point of view, one possible explanation for Walmart Inc's investment is:They are entering this potentially lucrative huge market by buying a very expensive option (ticket).The option represents the premium of the price paid by Walmart Inc over the Flipkart assessment price, reflecting the uncertainty and potential size of the Indian retail market.

The potential growth in the size of the Indian retail market and the uncertainty of this growth have created this option. But considering that Walmart Inc is still a brick-and-mortar store and can take a variety of approaches in this market, it is not enough to judge whether it is valuable to buy Flipkart.

3. Synergistic effectSimilar to merger cases, the word "synergy" is usually abandoned and has no support. If the essence of synergy in the merger process is to allow the merged entity to accomplish actions that a single entity cannot do on its own (faster growth, lower costs, etc.), then investors need to consider how buying Flipkart will generate more revenue for Walmart Inc's Indian retail stores, and how to accelerate the growth of Flipkart acquired by Walmart Inc and become profitable as soon as possible.

Walmart Inc does not yet have a large enough stock in India, but he has made a substantial profit from the Flipkart acquisition. Although Walmart Inc did announce the opening of 50 new stores in India after the Flipkart deal, owning Flipkart is not necessarily linked to the increase in its brick-and-mortar store traffic. At the same time, apart from continuing to provide capital, Walmart Inc has few ways to make Flipkart more competitive in the process of competing with Amazon.Com Inc. to make a long story short,If there is a synergy, investors will learn more aboutFlipkartThe value may be less than the price paid by Walmart Inc.

4.Defensive maneuverAs mentioned earlier in this article, both Flipkart and Walmart Inc have a common competitor-Amazon.Com Inc, which has been an excellent competitor for a long time. As capital dries up and existing investors seek to exit, Walmart Inc's global retail decline seems inevitable, coupled with the continued rise of Amazon.Com Inc, there is little chance that Flipkart will survive this business war alone.But given the difficulty of penetrating the Chinese retail market, the Indian retail market may be Walmart Inc's next foothold.In other words, Walmart Inc's reason for investing in Flipkart is not to expect a reasonable return on his $16 billion investment. The fact is, if they do not make this acquisition, Amazon.Com Inc will expand market share without restrictions, while Walmart Inc's decline curve will be steeper.

From the author's point of view, this explanation can best explain the trading motivation. Although defensive mergers are a sign of weakness, not strength, and point to a business model under pressure. If you are a shareholder of Walmart Inc, this will be a negative signal, so it is not surprising that Walmart Inc's share price has fallen. Continue the previous analogy of its life cycleWalmart Inc is an once beautiful but now aging actress who invests in160One billion dollars for this very expensive plastic surgery. Like all plastic surgery, it's only a matter of time before charm reappears.

In short, Walmart Inc's benefits from the deal are likely to be offset by the price paid.

The influence of M & A

The influence of M & A

In the long run, the deal may slow Walmart Inc's decline, but such a high purchase price is difficult to guarantee that Walmart Inc's shareholders will benefit from it.Walmart Inc's stock is valued at about $61, down about 25 per cent from its share price of $83.64 on May 18, 2018, according to the author's calculations.

In the short term, the acquisition is expected to accelerate competition in the already intensified Indian retail market.. On the one hand, Walmart Inc will continue to provide cash support for Flipkart, on the other hand, Amazon.Com Inc India will continue to provide additional services while continuing to reduce prices. That means both companies will face bigger losses, and smaller online retailers will not be spared. In essence, the final winner will be the vast number of customers of Indian retailers, but in the words of the Godfather, they can only agree, not refuse!

For startups across India, however, the deal may make Flipkart founders and their VC investors pay the price of building a loss-making cash-burning machine, spawning more bad behavior. Young companies will devote themselves to pursuing growth and more growth, abandoning their focus on profitability or building viable businesses. The only pursuit is "Flipkart". And venture capitalists will play more pricing games, pay prices for these losers who have no fundamentals, and then pass "Walmarization"to prove its rationality.

(this article is produced by Futu Information compilation team, compiled / qu Boya, proofread / Yang Weiyi Jiang Wenwen)