On Tuesday, the Hang Seng Index opened high and closed down 93.76 points, or 0.36%, to 26038.27 points. The transaction scale increased slightly. On Tuesday, the Hang Seng Index had mixed ups and downs throughout the day. Sands China led 4.54%, while Li Ning, Budweiser Asia Pacific, BYD shares, and Innovation and Technology Industries also led the rise; in contrast, Ali Health led the 10.88% decline, while China Resources Land, Haidilao, Country Garden, and China's overseas development had the highest declines. Today, the Hang Seng Index jumped low and dropped for a while in the early days, and the market mood continued to decline.

Overnight, US stocks remained strong, with the Dow, NASDAQ, and S&P 500 rising 0.04%, 0.06%, and 0.18%, respectively. The relatively good financial results for the third quarter strongly supported the continued strengthening of US stocks. International oil prices hit a seven-year high, and there is still room for market expectations to rise. Bank of America's “continued inflation” index reached a record high in September, and the issue of inflation is also the focus of market attention. The three major A-share indices of mainland China fell all on Tuesday, but the decline was small; the transaction scale of the two markets expanded, exceeding trillion yuan for three consecutive trading days. On the sector side, sectors such as beer concepts and graphene bucked the trend and strengthened, while sectors such as home appliances and medicine performed sluggishly. The market's profit effect was average, and there was no obvious direction.

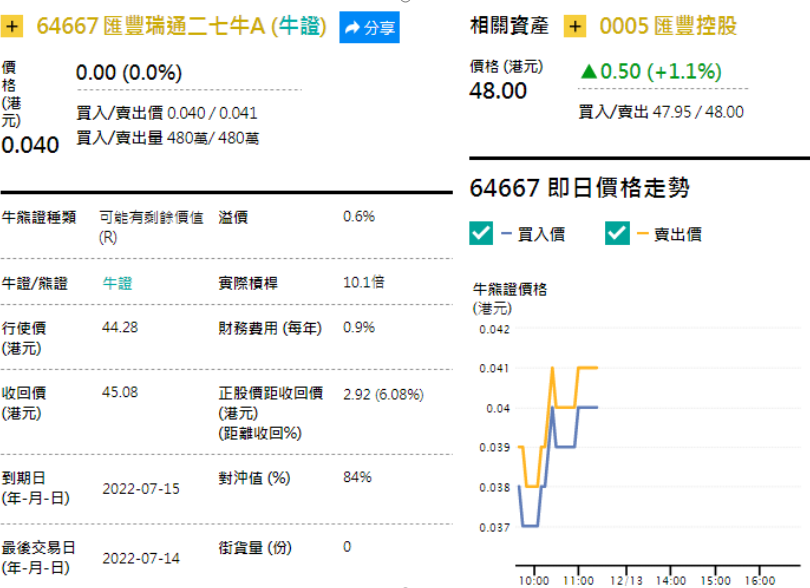

HSBC Holdings (0005.HK) rose 1.71% on Tuesday to close at HK$47.5. It rose for two consecutive trading days, and the transaction scale also increased. HSBC announced third-quarter earnings on Monday and plans to spend up to $2 billion to repurchase shares, boosting the trend. HSBC recently followed a 5-antenna upward trajectory, above several major moving averages. It fluctuated higher after opening slightly higher in early trading today. Continuing yesterday's upward trend, bulls are strong, and focus on the HK$50 resistance position in the short term. If you continue to be bullish, you can pay attention to HSBC's bullish certificate of 64667, with a recovery price of HK$45.08, with a leverage ratio of about 10.1 times; or pay attention to the HSBC subscription certificate 16,816, with an exercise price of HK$49.98, which expires on December 24, 2021. If you look down on HSBC's future market, you can pay attention to HSBC's bear certificate 55139, with a recovery price of HK$51.00, and a leverage ratio of about 10.6 times. You can also pay attention to HSBC's put note 28926, with an exercise price of HK$41.88, which expires on April 29, 2022. Investors can make rational choices depending on their ability to bear risk.