It's not surprising that stocks with no tech content have been thrown into the cold house.

According to the author's observation, now US stocks, A shares, and Hong Kong stocks are all based on logic. They identify good companies. They don't ask about stock prices, and buy them one step at a time. Basically, no one sees bad companies.

The strangest thing about the Hong Kong market is that when a milk tea shop went public last Monday, it actually went up to HK$2 billion. Little Hong Kong owners were dumbfounded by this financial momentum. Will a large number of milk tea shops, barbecue stalls, and fish and egg shops go public? With the exception of real estate and finance, where local enterprises in Hong Kong exalt their assets, it is difficult for other businesses to have a clear pattern of speculating on high growth, especially in the entertainment industry and retail industry. After mainland consumers have gradually grown rationally, it is too difficult for Hong Kong local enterprises to regain their former profit opportunities.

However, the good thing about the Hong Kong stock market is that there are quite a few high-quality technology companies in mainland China mixed in. For example, Ruisheng Technology and Shunyu Optical Technology, which everyone has seen in the mobile phone industry chain over the past few years, have given substantial returns to long-term investors. These include the biomedical representatives that have recently grown, Jinsirui, Pharmaceuticals, Fosun Pharmaceuticals, Zhongsheng Pharmaceutical, Shiyao Group, etc., all of which are good long-term growth targets. Their biggest characteristic is that the entity is in mainland China, scientific and technological research and development capabilities are in sync with or ahead of the world, and performance growth is growing steadily.

China's national transportation is now thriving. From heavy equipment from major countries such as manned space, quantum satellites, and the “China Sky Eye,” to high-speed rail, Alipay, bike sharing, and online shopping, known as the “Four New Inventions,” China's innovation achievements are currently exploding. In this round of global innovation competition, China has gone from being a “follower” to “running side by side”, and has thus become a “leader” in some fields.

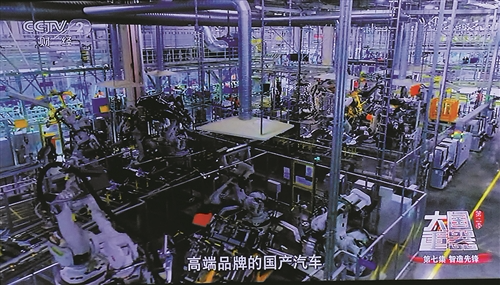

A few days ago, the CCTV financial channel broadcast the 7th episode of “Great Power Heavy Equipment” (season 2), “Pioneer of Intelligent Manufacturing”. We walked into Geely's Taizhou Road and Bridge Base. A section on automobile manufacturing using digital simulation technology showed people the benchmark process and technology of Chinese automobile manufacturing. At the same time, it also made the Chinese people understand the strength and style of Taizhou's intelligent manufacturing.

The “Heavy Equipment of a Great Power” column records the story of Chinese manufacturing moving towards a modern economic system, and the column group selected the Geely Lynk & Co processing plant as one of the stories, which not only acknowledged Geely's typicality in China's manufacturing industry, but also acknowledged the performance of Taizhou, a manufacturing capital in the modern economic system. The sixth episode of “Big Power Heavy Equipment”, “Winning in the Internet” included the Internet section for the first time. Meanwhile, the Tencent Security Joint Laboratory, as the only representative in the field of cybersecurity, fully restored to the audience the “Dark Cloud III” Trojan horse battle that affected the largest number of users in 2017, showing the important breakthroughs and innovative achievements of Chinese security companies in the core technology field.

Geely will announce its 2017 annual results with Tencent on Wednesday, and I'm sure investors will not be disappointed. Tencent, in particular, rarely has a target price lower than 500.00 yuan. Tencent at this stage is actually greatly affected by the fluctuations in the Nasdaq Index, but the Nasdaq hit a record high a few days ago, so I believe Tencent's stock price will not weaken either.

As for the new bright spots that have appeared in the Internet of Science and Technology stocks this year, it is none other than Kingdee Software (00268) recently. In fact, the market value of China's SaaS cloud service companies is less than 10 billion US dollars. According to the IDC research report, Kingdee has won “first place in five categories” in fields such as the SaaS cloud service market and China's growing enterprise application software market, such as overall enterprise SaaS cloud services, SaaS ERP, SaaS financial cloud, and mobile office segments. This is the first time that a Chinese software vendor has surpassed that of an international vendor in the field of enterprise SaaS cloud services in its market share.

The enterprise-grade SaaS service industry has basically matured, and a number of benchmarks have emerged in every vertical segment. For example, SAP (SAP), Oracle (Oracle), Salesforce... Data shows that the market capitalization of these three companies alone has exceeded 350 billion US dollars. However, in China, there are currently no real giants in various segments of the enterprise-level SaaS service industry. Judging from the market capitalization, Chinese companies are far from their American counterparts, which means that Goldbutterfly is seriously underestimated. Looking at stock prices, investors have paid no less attention to the “Unicorn” series recently. In the list of Chinese unicorn companies, cloud service unicorns include: Alibaba Cloud, Tencent Cloud, Jinshan Cloud, Baiwang Cloud, etc.

Hong Kong stocks need to evaluate stock prices based on performance. Kingdee's gross profit in 2017 was 1.88 billion yuan, up about 23.9% year on year, gross margin about 81.5%; operating profit was about RMB 420 million, up 69.0% year on year; and net cash from operating activities was about RMB 820 million, up 34.6% year on year.

According to a report on the Zhitong Finance app, Jindie founder and board chairman Xu Shaochun's hopes at the performance conference have changed from following strategy to transcending strategy after the last five years of exploration. In 2020, Kingdee will achieve the goal of accounting for 60% of cloud business revenue, thus promoting the company's market capitalization to reach 100 billion dollars in 2025. That is, a fivefold increase from the current stock price.

The market value of Salesforce, a leader in SaaS services in the US, has reached US$92.73 billion, and the market value of Workday, a vertical SaaS platform focusing on human resources services, has also reached US$288.41. As the first stock of “cloud services” such as SaaS in China, in A-shares or US stocks, I'm afraid the market capitalization is not just 5 times smaller.

Hong Kong stocks speculated on domestic housing stocks last year because their value was seriously underestimated and exploited by the Mainland's Hong Kong Stock Connect Southbound Fund. However, the essence of technology and biomedical stocks, which only began to recover in 2018, is that the internal growth of companies is not highly correlated with external factors (such as the Fed's interest rate hike, Trump team staff reduction, etc.). Instead, the performance of resource stocks and other cyclical sectors is clearly influenced by external factors.

The author predicts that this wave of technology-led Hong Kong stock market is estimated to last longer than the “2017 index bull”.